American companies are increasingly turning away from China and toward the Mexico, according to The New York Times. Labor costs are steadily increasing in China, while Mexico remains a source of inexpensive and skilled labor.

Mexico and China

Trading between Mexico and the U.S. has increased by 30 percent since 2010. In the meanwhile, trade with China has declined. In fact, many companies are leaving China and moving to Mexico, according to the Times. These companies include Plantronics, which makes headsets, and DJO Global, which manufactures medical supplies, amid others.

"When you have the wages in China doubling every few years, it changes the whole calculus," said Christopher Wilson, an economics scholar at the Mexico Institute of the Woodrow Wilson International Center for Scholars in Washington, according to the Times. "Mexico has become the most competitive place to manufacture goods for the North American market, for sure, and it's also become the most cost-competitive place to manufacture some goods for all over the world."

Companies expanding to Mexico are ultimately benefiting the U.S. economy more than if they expanded to China, the Times cited. Forty percent of the parts used in Mexican manufacturing come from the U.S., while China's products are only 4 percent of U.S. origin.

A winning example of a U.S. company that successfully offshored to Mexico

One company, called Flambeau, resisted the urge to move to China during the days when it was cheaper to build there and instead moved to central Mexico, according to the Times.

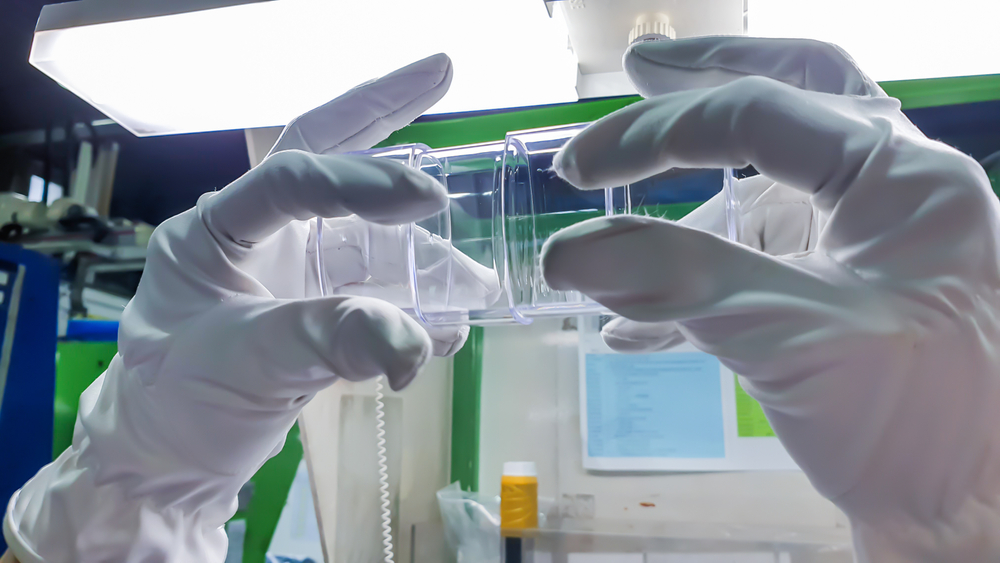

Flambeau manufactures plastics, including Duncan yo-yos and industrial items. Its revenue has increased by 80 percent since 2010, so much that the company now plans to open a second plant near Mexico City. The company has also seen a large number of firms come to it asking for custom plastic items, such as cases for smartphones or parts for manufacturing.

"It's not just about cost; it's about speed of response and quality," said Jason Sauey, president of Flambeau, regarding the influx of projects.

According to Sauey, his company has succeeded because of a careful mix of investments between the U.S. and Mexico. His company takes raw materials built in the U.S. - like the plastics that form his products - and then ships them to Mexico to be completed, before sending them back up to be sold in the U.S. Because of the North American Free Trade Agreement, this production process does not cost any extra cash in tariffs.

Pemex and China

Business is increasingly thriving in Mexico, and China is in talks to make a deal with the country. Chinese companies want to make a deal with Pemex, Mexico's state-owned petroleum company, to make an investment fund for financing energy projects like oil wells, according to Nearshore Americas. Pemex is in talks with Chinese companies like Xinxing Ductile Iron Pipes and SPF Capital Hong Kong Ltd., among others.

Mexican manufacturing sentiment increased in May

As a sign that Mexico continues to go strong despite its weak first quarter, the HSBC Mexico Manufacturing Purchasing Managers' Index rose to 51.9 in May from 51.8 in April, according to Reuters. This number reflects Mexico's increase in manufacturing new orders and a boost in employment for the second month in a row.

Any reading above 50 indicates that the industrial sector in Mexico is expanding. In March, the index reached a five-month low, but even during this low, the reading indicated expansion. In fact, Mexico's manufacturing industry has been increasing for the past eight months, according to the index.

"The return to more normal levels of production in the U.S. after the disruptive weather at the beginning of the year may support manufacturing production in Mexico," said Sergio Martin, chief economist at HSBC in Mexico, according to Reuters.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.