Mexico's electric vehicle (EV) manufacturing sector is rapidly gaining momentum as global automotive giants increasingly look to establish a foothold in the region. With favorable conditions such as proximity to the lucrative North American market, a skilled workforce, and robust infrastructure, Mexico has emerged as a strategic hub for electric vehicle production.

Major automakers like GM, Ford, and Stellantis have already begun producing electric vehicles in Mexico, capitalizing on cost efficiencies and logistical advantages. The country's proactive stance in attracting investments and its established automotive manufacturing capabilities further bolster its appeal.

As demand for electric vehicles continues to rise, Mexico's role in the EV manufacturing sector is poised to grow, supported by ongoing developments in technology, supply chain integration, and government incentives aimed at fostering sustainable automotive production practices.

EV tax credit conditions

The United States’ passage of the Inflation Reduction Act in July 2022 carried with it a new tax credit to support the purchase of commercial “clean,” or electric, vehicles, as well as modifications to a refundable tax credit for the purchase of new and previously-owned electric vehicles. Purchasers have the opportunity to achieve a $7,500 refund for vehicles that meet certain requirements.

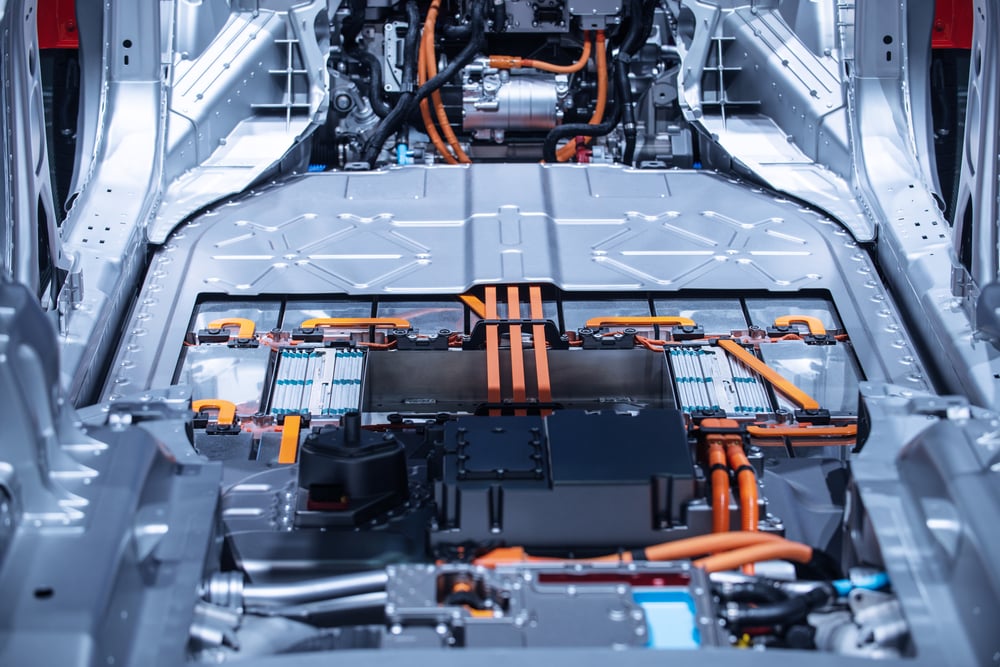

Among the stipulations limiting this credit is a requirement that the final assembly of any impacted clean vehicles must happen in North America. The act also sets requirements by which a certain percentage of critical minerals used in battery components must be processed in the United States “or in any country with which the United States has a free trade agreement in effect.” Those critical mineral and battery component requirements begin with a requirement for having 50% of North America-based content by Jan. 1, 2024, and rise steeply from there.

This is notable in that this limitation expressly prevents vehicles with China-made battery components from meeting credit requirements, as the U.S. and China do not currently have a free trade agreement. And while critics of the requirement bemoan the usefulness of the tax credits—saying they come carrying so many limitations that few cars will qualify—this criticism is only relevant when focusing on U.S.-made electric vehicles.

The truth is that Mexico’s automotive manufacturing industry has been positioning itself to meet the demand for electric vehicles for some time.

Mexico’s EV manufacturers

Manufacturers looking to offset the hefty cost of creating a largely new supply chain have increasingly eyed Mexico as a solution. The country’s automotive manufacturing sector has long benefited from cost savings achievable with a location in Mexico. More recently, global supply chain disruptions have pushed more manufacturers to bring production closer to their consumer base. Mexico has offered an opportunity for faster, less costly transportation of goods to the U.S. compared to manufacturing facilities in Asia.

Today, GM and Ford Motor Co. are producing electric vehicles in Mexico, and other companies are looking to follow suit. Jeep parent company Stellantis NV is reportedly considering renovating its Saltillo plant for the production of hybrid and electric vehicles. The company already makes the Jeep Compass crossover at an assembly plant in Toluca and has announced plans to bring an all-electric version of the Compass to that plant by 2024.

However, virtually all major automotive OEMs have a presence in Mexico. While it’s no easy feat to change over production, automotive manufacturers may find increasing incentives to focus their production in Mexico on EV offerings.

Meeting demand for EV components

As electric vehicles grow in demand, there’s been a significant uptick in the need for lithium to develop EV batteries. One report indicates that demand for lithium from the EV sector will account for nearly three-quarters of its consumption by 2030, up from 41% in 2020. As a result, manufacturers have been looking for new lithium mines.

While Tesla has contracted with an Australia-based lithium mine to provide components for EV battery production, the short-term contract hints that the car manufacturer may also be positioning itself for a more strategic partnership. In Dec. 2021, Tesla began production at its Austin, Texas, gigafactory, just four hours from Laredo at the U.S.-Mexico border.

Now, the world’s biggest EV battery maker, China’s Contemporary Amperex Technology Co., is evaluating two locations in Mexico for a manufacturing plant that would potentially supply Tesla and Ford Motor Co. The battery maker is reportedly considering Ciudad Juarez, Chihuahua, and Saltillo, Coahuila, the latter of which has earned the nickname “Little Detroit” due to its robust automotive manufacturing sector.

In addition, the Mexican government is exploring ways to expand access to its lithium resources. The Mexican state of Sonora is home to one of the world’s largest lithium deposits.

Position your automotive factory for success

Certainly, the U.S. Inflation Act favors U.S.-made vehicles. In addition to the stipulations set around the tax credits, the act also sets aside funding to support the domestic production of efficient hybrid, plug-in electric hybrid, plug-in electric drive, and hydrogen fuel cell electric vehicles. However, it takes time to make these investments. The longer automotive manufacturers take to bring their component manufacturing and assembly onshore, the farther they risk falling behind the competition.

The good news is that Mexico’s automotive manufacturing industry has already put into motion work to create the infrastructure needed to support this supply chain shift. If you’re ready to see how a location in Mexico can help position your company to take the lead in the growing EV industry, contact Tetakawi today.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

.jpg)