If you're grappling with the complexities of wage calculation in Mexico, you're not alone. With unique labor laws and cultural norms, the task can be daunting, especially for those used to the hourly rates in countries like the United States. Updated for 2023, this guide aims to simplify the process and provide actionable insights for companies who are thinking about manufacturing in Mexico.

Why is Wage Calculation Different in Mexico?

In Mexico, wages are often expressed as a daily rate, applicable for all 365 days of the year. This is unlike countries like the United States, where wages are usually quoted in dollars per hour. This daily rate serves as the foundation for calculating various benefits and entitlements, such as severance pay and overtime rates. Understanding this key difference is crucial for businesses looking to expand into Mexico.

How Do Shift Types Affect Weekly Hours in Mexico?

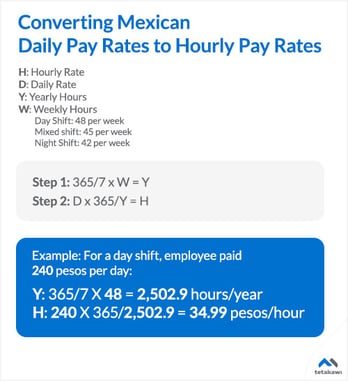

Different types of shifts have different weekly hours, affecting the overall wage calculation. Here's a quick breakdown of work shifts in Mexico:

- Day-Shift: 48 hours per week

- Night-Shift: 42 hours per week

- Mixed Shift: 45 hours per week

What Changes to the Mexican Workweek Are Expected in 2023 and Beyond?

Recent discussions have proposed reducing the Mexican workweek to 40 hours. While the exact implementation date is still uncertain, this change could significantly impact work schedules. Questions remain about how this will be phased in and what it means for night-shift and mixed-shift employees. Employers should stay updated on these potential changes to ensure compliance and effective labor management.

How Can You Calculate a Comparable Hourly Wage in Mexico?

To calculate an hourly wage comparable to a U.S. pay rate, multiply the daily rate by 365 to get the annual pay. The annual hours worked equals the weekly hours per shift times 52 weeks per year. Dividing the annual pay by the annual hours worked gives you a comparable hourly rate. This method allows for a more apples-to-apples comparison between wages in Mexico and the United States, aiding businesses in making informed decisions.

Average Wages & Mexican Labor Rates for Manufacturing in Mexico

How Do Vacation and Holidays Affect Hourly Wages in Mexico?

Federal law mandates a minimum level of vacation after one year of service and establishes seven paid statutory holidays (eight in presidential inauguration years). Union agreements may add holidays or vacation entitlement beyond the legal minimums. To get an hourly wage for the hours actually worked, deduct the paid vacation and holidays from the yearly days worked and recalculate the total hours. Understanding these nuances is crucial for accurate wage calculation and labor cost projections.

Why is the Daily Rate Important for Benefits?

While an hourly rate makes it easier to compare wages with those in the United States, the daily rate is crucial for certain benefits and legal requirements. For instance, Christmas bonuses (the Aguinaldo) are mandated by law. At least 15 days of pay at the employee's usual daily rate is required as a Christmas bonus by law. Unions and senior employees may negotiate for larger bonuses, but they are still typically expressed as a number of days at the employee's daily rate.

Ready to Calculate Your Own Payroll Costs in Mexico

Understanding how to calculate wages in Mexico is essential for any employer looking to operate successfully in the country. This guide, updated for 2023, provides you with the essential, actionable insights you need. For a more detailed calculation tailored to your needs, consider using our free online payroll calculator or listening to our podcast on labor costs in Mexico.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

Table of Contents:

- Why is Wage Calculation Different in Mexico?

- How Do Shift Types Affect Weekly Hours in Mexico?

- What Changes to the Mexican Workweek Are Expected in 2023 and Beyond?

- How Can You Calculate a Comparable Hourly Wage in Mexico?

- How Do Vacation and Holidays Affect Hourly Wages in Mexico?

- Why is the Daily Rate Important for Benefits?

- Ready to Calculate Your Own Payroll Costs in Mexico