Asia and Mexico have both experienced rapid economic growth in the past decade. According to IndustryWeek, a report from the MAPI foundation found Mexico is expected be the manufacturing growth leader in Latin America by 2016. Similarly, Asia Times reported global insights firm IHS forecasts that China's trade to North America and Europe will increase by more than 5 percent per year between 2015 and 2020.

While Asia's economic health certainly creates a level of competition for manufacturers in Mexico, the reality is that the benefits of Labor and proximity to high-demand markets make Mexico a more appealing location for even Asian companies. Still, Asia's economic health has positive implications for the manufacturing sector in Mexico.

An interconnected system

The key implication of Asia's economic growth is the fact that to be successful in any industry, governments need to embrace the reality of an interconnected system. Singapore is an excellent example of Mexico embracing multipolarity with Asia. According to International Enterprise Singapore - the government agency driving Singapore's external economy - 2015 marks the 40th year of bilateral relations between Singapore and Mexico, which doubled in the last decade to $3.83 billion.

Trade relations between Latin America and Mexico have implications for manufacturers.

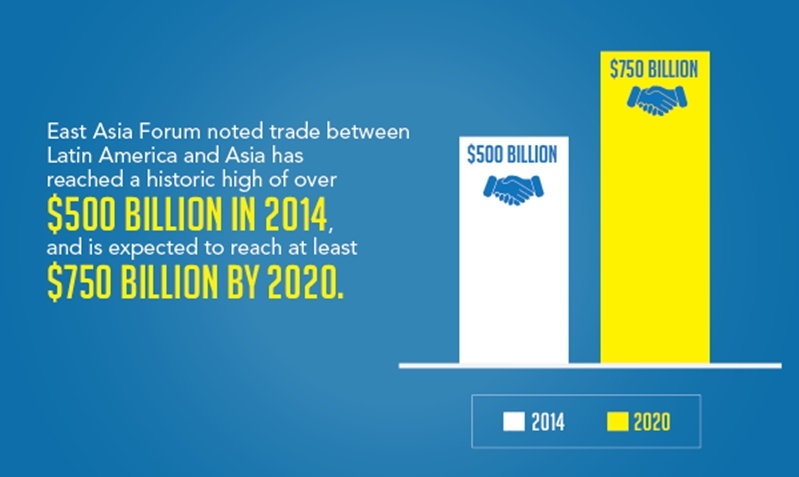

Trade relations between Latin America and Mexico have implications for manufacturers.With regard to the entire Asian region, East Asia Forum noted trade between Latin America and Asia has reached a historic high of over $500 billion in 2014 and is expected to reach at least $750 billion by 2020. This increase is largely the result of policy reforms in Mexico as well as NAFTA, which give Asian businesses direct access into the U.S. and Canada.

Open trade between the two regions is a product of a highly interconnected system that has a direct impact on manufacturers of all industries. As trade and ecommerce between the two countries continues to grow, manufacturers in both regions will need to be prepared to scale their operations to embrace multipolarity.

A supply-chain partnership

One of the strongest links between countries within the ASEAN Free Trade Area and Mexico is supply-chain logistics. As noted by AsiaOne 20, ASEAN will become the central global manufacturing supply chain hub with exports spanning across the world by 2030 at the latest.

As noted by Supply & Demand Chain Executive, there is a growing trend of auto manufacturers moving part of their production from Asia to North America in response to increased production costs and growing complexity and risk of supply chains from Asia to the U.S. This doesn't mean production investment in Mexico is coming at a cost to Asia, though. Foster Finley, a managing director of logistics consulting firm AlixPartners, told The Journal of Commerce that investment in manufacturing in Mexico is complementing investment in Asia. This is because auto manufacturers, in particular, are moving the production portion of manufacturing to Mexico to leverage the country's proximity to the U.S. as a solution to supply-chain challenges.

As Asia continues to experience economic health, Mexico will have an upper hand compared to the U.S. and North America when it comes to trade and supply-chain partnerships.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.