Manufacturing in Mexico is becoming more appealing to businesses in North America and Asia due to lower labor costs, the country's 44 free trade agreements and, of course, close proximity to the U.S. This means more manageable and cost-effective supply chain logistics. The Journal of Commerce reported that Department of Transportation data showed a four percent increase in the number of tractor-trailers crossing U.S. borders from Mexico since 2014 as a result of these conditions.

More companies are moving to Mexico to leverage the country's proximity to the local or regional supply chain. In fact, the supply chain logistical shift has motivated companies like DHL to offer solutions to make cross-border shipping and transactions easier, Fleet Owner Reported. In response to the trend, DHL launched Trans Border Connect, a service that will help shippers move less-than-truckload freight over the U.S.-Mexico border, handling shipments to and from five strategic markets in the U.S. and Mexico.

In order to benefit from Mexico's close proximity to the U.S., it is important to be prepared with knowledge of the logistical climate, relations with other major regions and key strategies for maximizing efficiencies.

Mexico's Logistic Advantage: The Cost of Freight in Asia

The cost of moving freight from Mexico throughout North America pales in comparison to the freight rate in Asia. Roy Austin, business development director for ILS, The Offshore Group's logistics provider, noted that many Asian companies are moving either their assembly or the entirety of their operations to Mexico to take advantage of lower costs and faster speed to market.

"A primary issue is lowering freight cost for manufactures who are currently battling soaring freight rates from Asia," Austin explained. "Improving speed to market, reducing inventory cost and improved supply chain transparency are major advantages to procurement teams who leverage the proximity of Mexico."

Despite these benefits, there are still many challenges that manufacturers within the automotive, aerospace, electronics and medical device sectors face, particularly with regard to their lower-tier suppliers. OEM and Tier 1 manufacturers must find a feasible way to bring their lower-tier suppliers into the country to maximize the financial benefits of manufacturing in Mexico, rather than continuing to lose money on the soaring freight costs of lower tier goods in Asia and other regions.

Challenges: Ambiguous Regulations

Perhaps one of the greatest challenges businesses will face when manufacturing in Mexico is the lack of regulation the Mexican government places on brokers and logistical providers in the country. Further, Inbound Logistics outlined three significant regulatory challenges manufacturers in Mexico could face:

1. Unclear relationships and handoffs between truckers and brokers at the U.S.-Mexico border

2. Cargo liability, which holds Mexican customs brokers liable for comparing the physical freight to the documentation to ensure consistency

3. Truck weight limits, which are not harmonized by the three NAFTA countries

Austin insists communication and relationship building are the keys to overcoming these challenges.

"Freight Brokerage and logistics services are not regulated, and shippers must fully understand that relationships are everything to a stable supply chain framework," Austin said. "Find a logistics provider that is credible, honest and willing to help mitigate transportation risks."

Mexico Shipping: The Role of e-commerce

The rise of e-commerce is bound to have a major impact on how manufacturers in Mexico handle supply-chain logistics, especially for companies within the electronics and furniture manufacturing industries.

"I believe global e-commerce across international borders will define a new era of shipping," Austin stated. "International online transactions will be a way of life in the future, just as domestic online shopping feeds our souls today."

As e-commerce becomes a way of life for consumers, there will be increasing demands on companies to improve speed to market, and creating efficiencies in this arena will depend on manufacturers' abilities to optimize their logistical operations.

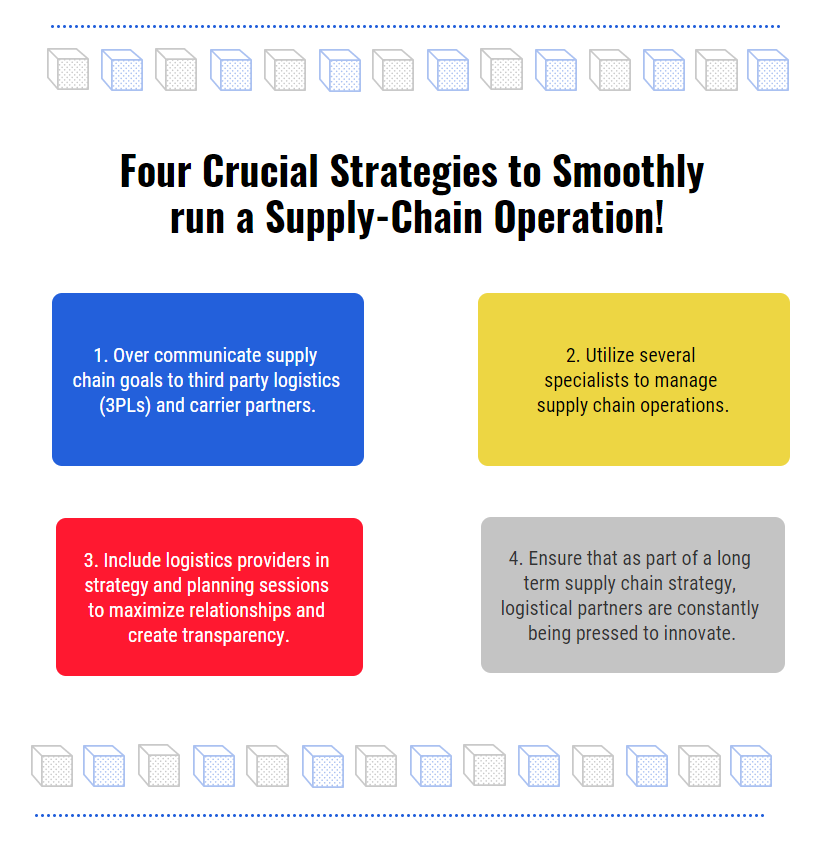

Beyond having a deep understanding of the logistical environment, Austin recommends four crucial strategies manufacturers can employ to run smooth supply-chain operations when offshoring to Mexico:

Manufacturers in Mexico can overcome supply chain challenges and capitalize on the country's close proximity to high-demand markets by partnering with a knowledgeable, innovative and resourceful logistics provider.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

.jpg)