Understanding labor regulations is paramount for any company operating in Mexico, as adherence to these laws ensures compliance and fosters a positive work environment. Mexico's Federal Labor Law governs various aspects of employment, ranging from work schedules and wages to employee rights and termination procedures.

By familiarizing themselves with labor regulations, employers can navigate complexities such as working hours, overtime pay, and holiday compensation effectively. Moreover, staying aware of updates and changes to labor laws helps companies mitigate risks and uphold the rights of their employees. Partnering with experienced shelter service providers like Tetakawi can further support businesses in interpreting and applying labor regulations, ensuring seamless operations and promoting a culture of compliance within the workforce.

While many of these factors will be familiar to employers from other countries, there are some unique differences of which to be aware. In this article, we explain what employers need to know about working hours, wages, and other payroll factors in Mexico.

Free Download: The Guide to Navigating Mexican Labor Laws

What are the working hours in Mexico?

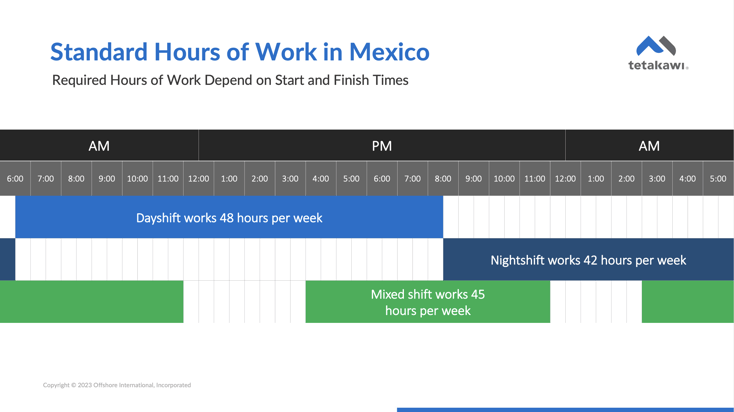

Mexican Labor Law, Article 59-62, establishes that the legal length of the Mexican workweek depends upon the shift on which an employee renders service. Average working hours in Mexico vary, but the maximum workweek for a full-time employee in Mexico is 48 hours. The hours for each shift are spread over a six-day workweek that runs from Monday through Saturday. Workers are entitled to a 25 percent premium for working on a Sunday.

The Mexican workday is divided into three specific shifts:

- The day shift in Mexico is eight hours long. These hours can fit anywhere between the hours of 6:00 a.m. and 8:00 p.m. A full-time Mexican day-shift worker spends 48 hours on the job during the workweek.

- The night shift in Mexico occurs during a seven-hour period between 8:00 p.m. and 6:00 a.m. Full-time night shift workers in Mexico spend a total of 42 hours on the job during their workweek.

- The mixed shift in Mexico is 7.5 hours long, and can consist of hours across both the day and night shifts. However, the night shift component of a mixed shift is limited to 3.5 hours. Full-time mixed shift workers spend a total of 45 hours on the job during their workweek.

Mexican Labor Law stipulates that workers are entitled to a thirty-minute meal break during each shift. In addition, many companies in Mexico commonly provide extra break time to help workers focus and remain fresh.

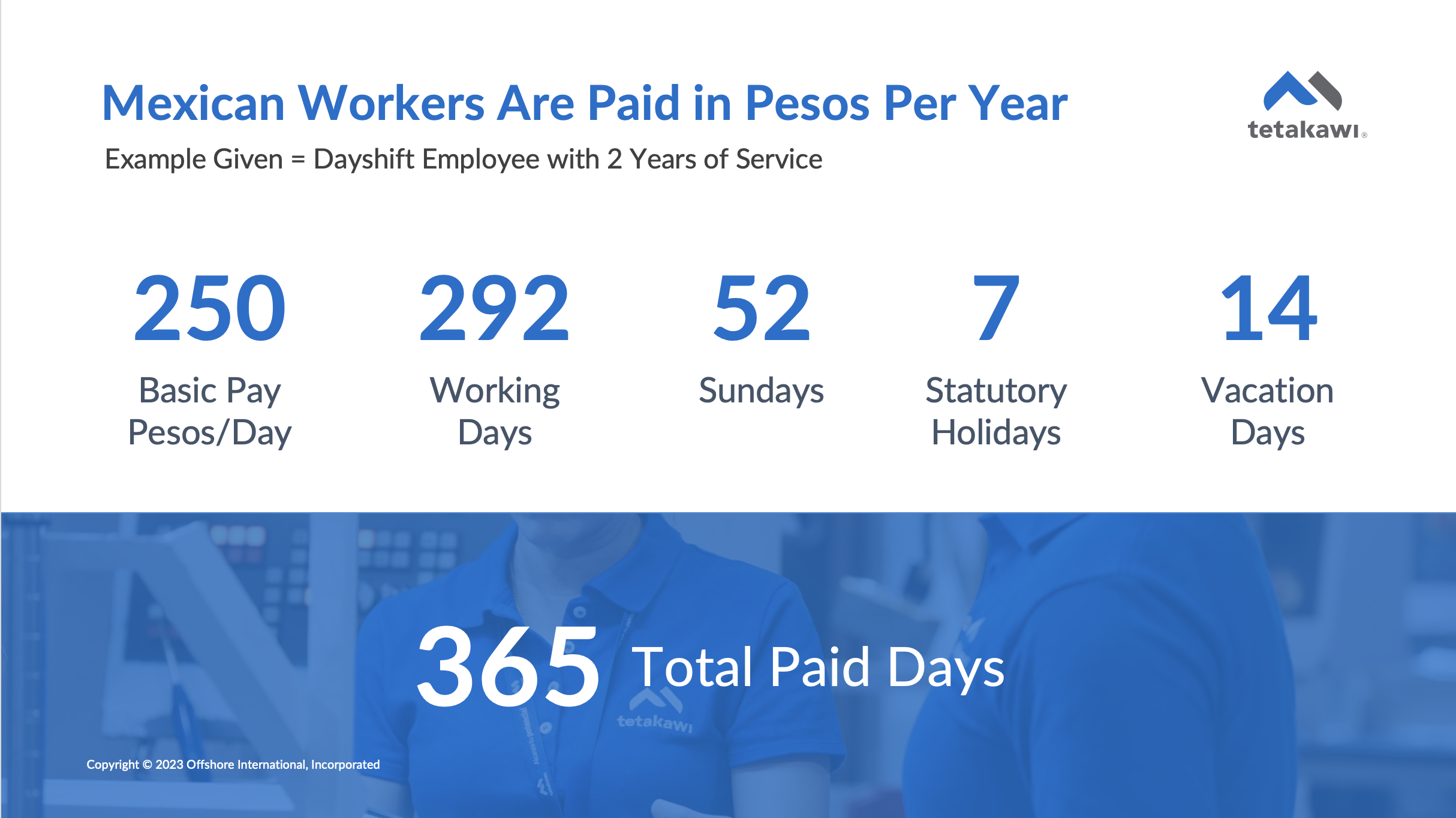

How are wages in Mexico calculated?

Wages in Mexico are rarely expressed as hourly rates. Instead, Mexican Federal Labor Law dictates that wages be expressed as a daily rate of pay for all 365 days of the year. These wages are accounted for daily rather than hourly and are customarily paid out weekly. The daily rate is based on the specific shift the employee works and any other benefits factored into their contract.

In 2023, Mexico increased the minimum daily wage by 20 percent from the year prior to 207.44 pesos ($11.54 USD) per day of work or 312.41 pesos ($17.38 USD) in the economic free zone along the northern border. Though this number varies based on location, position, and other industry-related factors, the general calculation remains the same. Each workweek shift is provided with the same pay, accounting for the differences in the number of hours worked in the day, night, and mixed shift schedules. One thing to keep in mind is that most manufacturing companies in Mexico pay wages above the minimum wage.

Listen to our Manufacturing in Mexico podcast for a more detailed overview of labor costs in Mexico:

Must Read Article: How to Calculate Wages in Mexico

Do employers pay overtime to workers in Mexico?

In Mexico, overtime applies to any hours the employee works beyond the legal requirement in a week, per Article 66 of the Federal Labor Law and Section XI of Article 123 of the Mexican Constitution. More specifically, overtime is paid after employees reach the legal number of hours stipulated by their shift. In general, employees in Mexico are paid double the typical salary for the first additional nine hours of overtime, and then the rate triples.

Whether a worker is hourly or salaried, this overtime rule generally applies. Though it is common for salaried employees to follow the custom of expressing their pay in terms of a monthly salary, the underlying daily rate still applies when dealing with legal requirements.

Do federal holidays apply to the workweek in Mexico?

Employees that work holiday shifts are entitled to holiday compensation that is double their pay, in addition to regular daily pay, according to Articles 74 and 75 of the Federal Labor Law. Mexican federal holidays include:

- January 1: New Year’s Day

- 1st Monday in February: Constitution Day (occurs the first Monday in February)

- Third Monday in March: President's Day / Benito Juarez Day

- May 1: Labor Day

- September 16: Independence Day

- Third Monday in November: Revolution Day

- December 1: Presidential Inauguration Day (every six years)

- December 25: Christmas Day

In addition, many employers also allow workers time off for other religious or national celebrations.

Article 132 of Mexico's Labor Law also specifies that workers are entitled to an annual bonus to be paid in December, equivalent to a specific percentage of a worker's salary. This end-of-year bonus, or "aguinaldo," is also known as "13th-month pay" and is disbursed before Christmas on December 20.

What other payroll factors impact wages in Mexico?

Outside of hours worked, employees in Mexico also receive leave for events such as maternity, adoption, paternity, sickness, and care of minors (specifically, cancer care) as mandated by Mexican Labor Law. Annual leave is awarded based on years of service and provides employees time off for years worked. Retirement, insurance, and other fully-fringed benefits also impact an employee's take-home wages.

What happens at the end of the working relationship?

The benefits that employers must pay out to employees will vary based on how the working relationship ends. In preparation for such an ending, it is extremely important for employers to keep detailed resignation records. In some cases, a worker may argue termination without cause – despite voluntarily resigning – and decide to exercise the right to sue. Mexico’s strong culture of employee protection means that a lack of solid evidence and thorough documentation of willing departure is likely to tip the court's judgment in favor of the worker.

Below, we explain the financial and legal impact of terminating an employee, with or without cause, as compared to an employee’s voluntary resignation.

Termination of employees and severance in Mexico

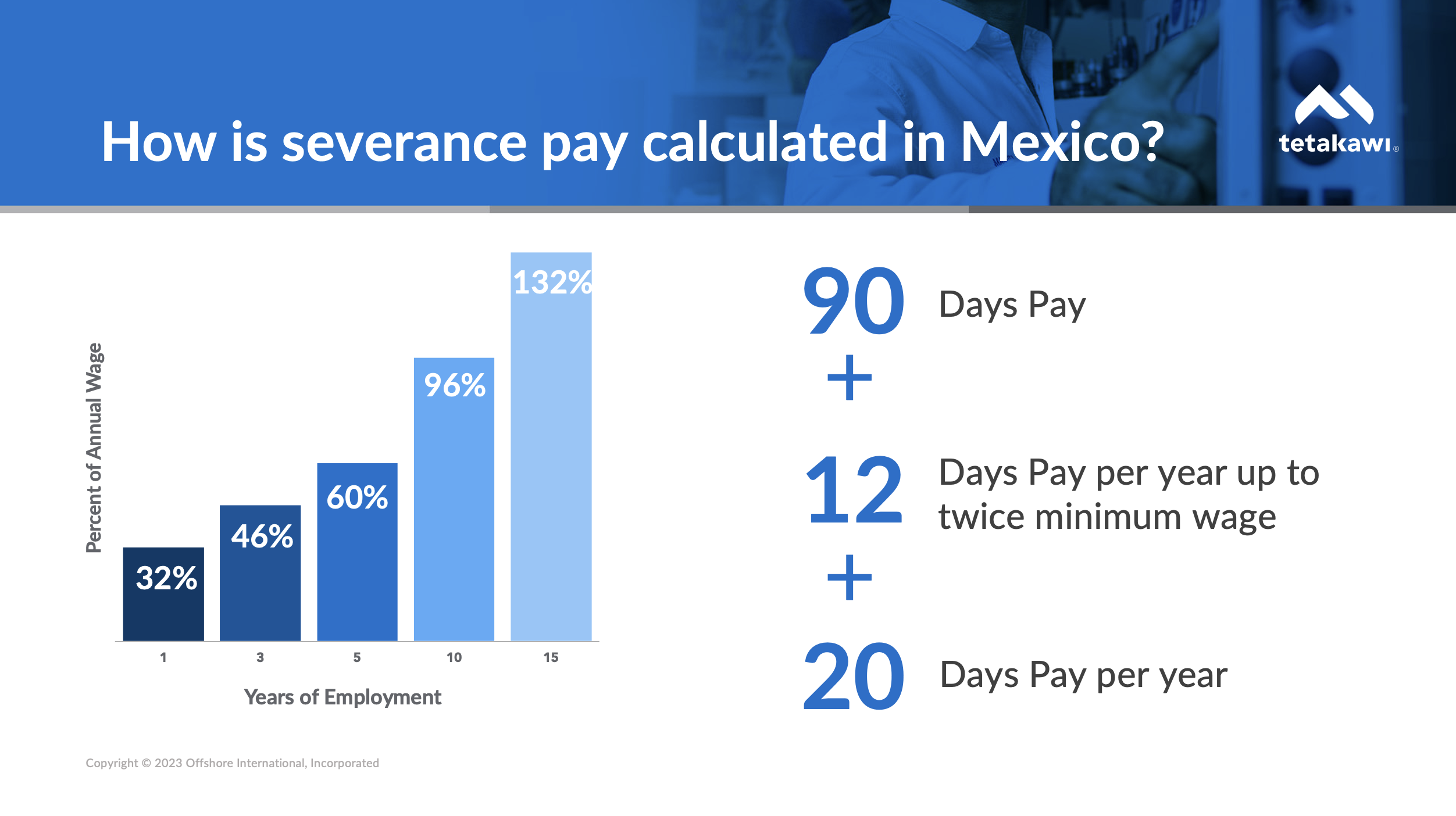

Employees that are terminated without cause are entitled to certain benefits. Under Mexican Labor Law, an employee with two or more years of service who is terminated without cause has the right to file for reinstatement. If not reinstated, the dismissed worker is entitled to a severance package. Components of the package can include:

- Accrued benefits that may be outstanding (e.g., the prorated portion of vacation, bonus, and saving fund).

- Seniority premium is equal to 12 days of wages per year of service, calculated using the lesser of the most recent daily rate or twice the federal minimum wage.

- Integrated salary is equal to 90 days of wages at the most recent daily rate.

- 20-day wage entitlement, in which the employee receives 20 days of wages per year of service, calculated using the daily rate and with no limits on the years of service.

The dismissed worker is also entitled to any salary accrued between the time of termination and delivery of the severance package, so prompt payment is prudent.

Employees that are terminated with cause are only entitled to receive:

- Accrued benefits that may be outstanding (e.g., the prorated portion of vacation, bonus, and saving fund).

- Seniority premium is equal to 12 days of wages per year of service, calculated using the lesser of the most recent daily rate or twice the federal minimum wage. This is relevant only if the employee has at least 15 years of continuous service with the employer.

Because the termination of employees is closely regulated in Mexico, the scenarios that warrant fair cause typically involve significant violations. Situations like minor rule-breaking or low productivity generally do not apply. Legitimate reasons for termination include major delinquency or absenteeism, employee arrest or imprisonment, deception, fraud, or disloyalty (in the form of revealing trade secrets), and other major violations.

In some cases, it may be preferable to settle the termination on terms mutually beneficial to both the employee and employer. If, for example, a senior employee is terminated for poor performance or a transgression that may negatively impact career prospects, the employee may not wish to broadly reveal the details in court. Instead, the employee may be willing to admit some liability and accept a mutually agreeable sum. In most cases, this is beneficial as the payment is typically less than full severance but avoids the cost, time, and exposure of litigation.

You can learn more about how severance pay is calculated here.

Voluntary resignation in Mexico

An employee that voluntarily resigns from employment in Mexico is entitled to:

- Accrued benefits that may be outstanding (e.g., the prorated portion of vacation, bonus, and saving fund).

- Seniority premium is equal to 12 days of wages per year of service, calculated using the lesser of the most recent daily rate or twice the federal minimum wage. This is relevant only if the employee has at least 15 years of continuous service with the employer.

No other payments are required. Employees that willingly depart from their positions or otherwise abandon them do not receive severance pay.

Again, it is extremely important to keep detailed resignation records. In some cases, a worker may argue termination without cause – despite voluntarily resigning – and decide to exercise the right to sue. Without solid evidence and thorough documentation of willing departure, the court's judgment is likely to favor the worker, given the strong culture of employee protection in Mexico.

How a Shelter Service Provider Can Help Navigate Mexico's Labor

Navigating Mexico's labor laws can be complex due to the intricacies outlined in this article. To address this, many manufacturing companies, regardless of size or industry, opt to collaborate with shelter service providers such as Tetakawi. These providers offer invaluable expertise and insights to streamline the navigation of Mexico's labor environment.

Shelter service providers interpret and apply the Federal Labor Law, ensuring your business adheres to the regulations regarding statutory benefits, paid time off, and mandatory bonuses. This support enables your business to design competitive benefits packages that comply with Mexican law.

Understanding the structure of the work week, including pay calculation for Sunday and holiday work, is another area where their expertise proves beneficial. This ensures accurate compensation and promotes a positive working relationship with your employees.

Providers also assist with vacation benefits and the mandatory vacation bonus, ensuring your business meets these obligations in relation to employees' length of service.

Additionally, they provide guidance on year-end obligations, such as the aguinaldo, ensuring these requirements are fulfilled in a timely manner.

In summary, shelter service providers like Tetakawi are essential partners for businesses operating in Mexico. Their support ensures compliance with labor laws, creates a favorable work environment, and allows your business to focus on growth and success in the Mexican market.

Learn more about working hours, wages, and Mexico's Federal Labor Law

Understanding the basics of the Federal Labor Law is extremely useful for any company thinking about manufacturing in Mexico. However, it is also important to keep in mind that this is an evolving document, and changes are made regularly to ensure worker protection. This is an area where Tetakawi can help companies ensure they are operating in full compliance with the latest labor requirements.

To get a primer on Mexico's Federal Labor Laws and how to navigate them, download the free guide here or contact a Tetakawi expert.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

Table of Contents:

- What are the working hours in Mexico?

- How are wages in Mexico calculated?

- Do employers pay overtime to workers in Mexico?

- Do federal holidays apply to the workweek in Mexico?

- What other payroll factors impact wages in Mexico?

- What happens at the end of the working relationship?

- Termination of employees and severance in Mexico

- Voluntary resignation in Mexico

- How a Shelter Service Provider Can Help Navigate Mexico's Labor Environment

- Learn more about working hours, wages, and Mexico's Federal Labor Law