Companies considering offshoring in Mexico to benefit from low labor costs must have a complete picture of labor protections in mind before they make a move. Low costs do not equate to unregulated conditions. Quite the contrary, Mexican Federal Labor Law sets out detailed employee protections that ensure your workforce receives fair pay, adequate benefits, and a safe working environment.

Due to regular reforms to the Federal Labor Law, foreign employers often find it beneficial to work with a local HR expert. These professionals can provide guidance on regulatory requirements and pending changes. This ensures that foreign manufacturers remain in compliance with all requirements around work relationships, payroll, benefits, employment agreements, and social security payments.

In the article below, we outline key elements of Mexico’s employment laws to help employers understand what to expect before they begin hiring.

The average workday in Mexico

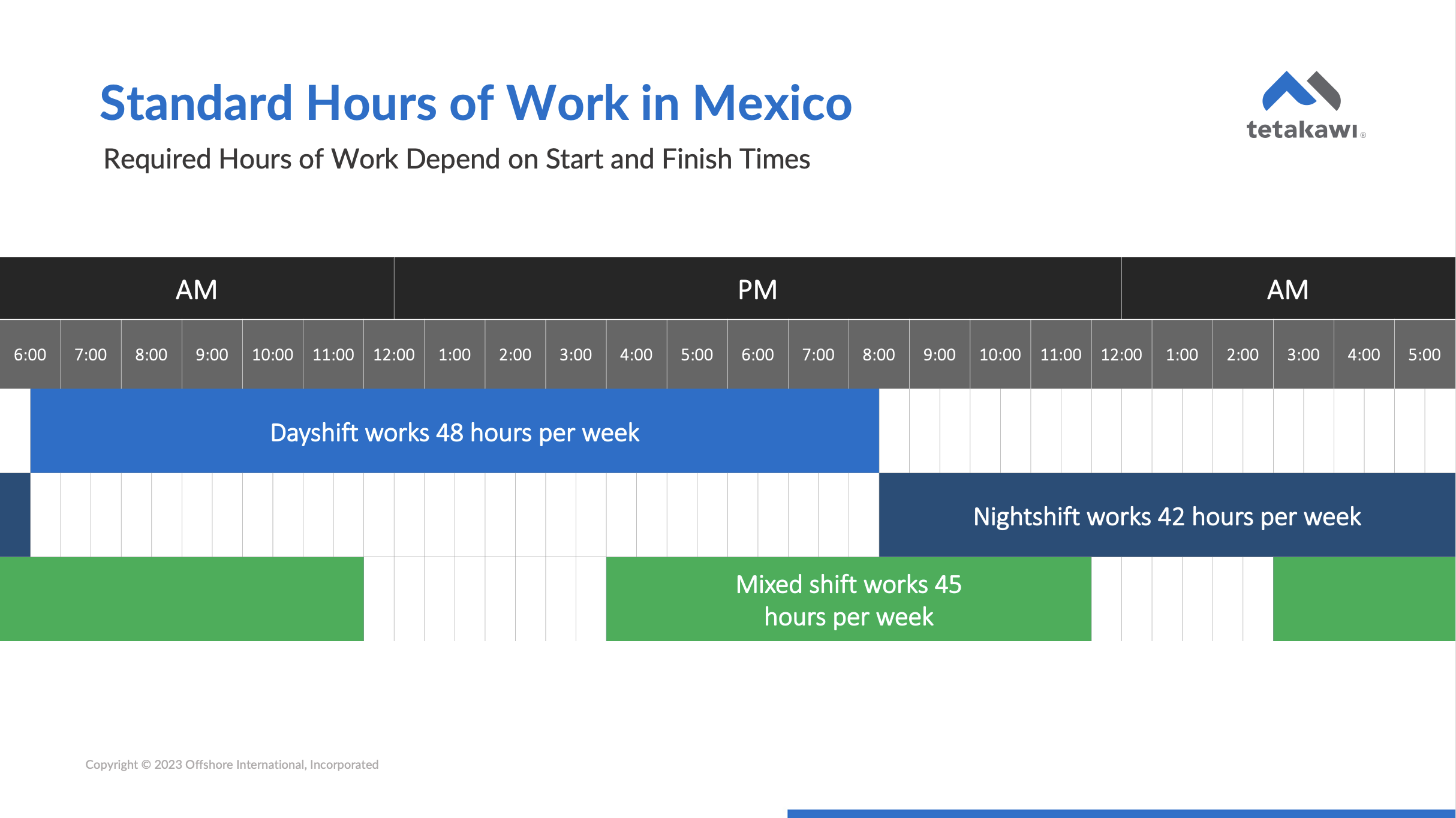

The average work day in Mexico is between seven and eight hours long, spread across a six-day workweek with a rest day on Sunday. Mexico's employment laws establish three shifts:

- Day shift: This 8-hour shift can fit between the hours of 6:00 a.m. to 8:00 p.m. A work week for a full-time day employee is 48 hours.

- Night shift: This shift falls during a 7-hour period between 8:00 p.m. and 6:00 a.m. Full-time workers on the night shift average 42 hours on the job each week.

- Mixed shift: This 7.5-hour shift is a blend of hours between day and night shifts with no more than 3.5 hours worked at night. Full-time mixed-shift workers spend 45 hours on the job each week.

The Mexican Federal Labor Law requires employers to provide a 30-minute meal break during each shift. Many companies provide extra break time as well.

Hourly wages in Mexico

As of 2024, Mexico’s Federal Labor Law continues to express wages as a daily rate of pay, rather than an hourly wage. In 2024, the daily minimum wage in Mexico rose by 20% to MXN $248.93, or approximately USD $13.83, while the Northern Border economic free zone increased to MXN $374.89, around USD $20.83, using an exchange rate of 18 USD to MXN. This increase aims to gradually improve the purchasing power of the Mexican workforce. It's important to note that these values may fluctuate due to exchange rate variations, and it's advisable to check for the most current rates and information.

To attract skilled manufacturing laborers, employers should expect to offer more competitive pay above minimum wage. However, this number will vary based on the location. Workers closer to the northern border and in some more metropolitan areas with manufacturing centers will expect a higher rate of pay.

Workers’ full daily rates are based on the specific shift worked as well as any other benefits factored into their contract. Wages are typically paid out on a weekly basis.

Why are wages so low in Mexico?

Despite the recent increase in Mexico's minimum wage, wages for manufacturing employees remain low due to various factors, including historically stagnant wages. However, employers are often willing to pay more competitive salaries to attract skilled manufacturing laborers. This is because manufacturing is a crucial industry in Mexico, and many companies benefit from keeping labor costs low while maintaining high production rates. Compared to minimum-wage workers in other industries, manufacturing employees can expect higher hourly wages, making it an attractive career choice for those with the necessary skills. As a result, employers should be prepared to offer competitive wages to attract and retain skilled manufacturing workers.

How is overtime paid in Mexico?

Mexico's Federal Labor Law outlines specific regulations for overtime pay, which must be adhered to by all employers in the country. In accordance with Article 66 of the law and Section XI of Article 123 of the Mexican Constitution, employers are required to pay overtime at a rate of double the typical salary for the first additional nine hours of work beyond the legal shift hours. After this point, the rate triples, ensuring that workers are fairly compensated for any additional time spent on the job. Employers must also ensure that workers do not exceed the maximum number of legally allowed work hours in a given week, as outlined in the law. By following these regulations, employers can ensure that they remain in compliance with Mexico's employment laws and maintain positive relationships with their workers.

Social Security requirements in Mexico

Social security is an essential component of the Mexican Federal Labor Law, and all employers are required to register with and contribute to the Mexican Institute of Social Security (IMSS). This applies to all workers except those who earn the minimum wage in their region. Social security payments are made to workers to cover various aspects, including occupational accidents, retirement and survivor pensions, disability, sickness, and other medical benefits. Additionally, social security also covers maternity care, child care, and other social services.

The Mexican government places great emphasis on social security, and employers must ensure that they make timely contributions to the IMSS. Failure to make these contributions can lead to significant financial penalties, which can negatively impact the company's bottom line. As a result, employers must prioritize social security contributions to ensure that their employees are adequately covered.

Workers who are registered with the IMSS are entitled to medical care, including hospitalization and medication, as well as rehabilitation services, prosthetics, and orthotics. This is in addition to the benefits mentioned earlier, such as retirement and survivor pensions, disability, sickness, maternity care, and child care. Employers who provide these benefits to their workers can attract and retain quality employees, which ultimately benefits the company. Moreover, offering these benefits can enhance the company's reputation as an employer of choice, which can lead to increased business opportunities.

In conclusion, social security is an essential aspect of the Mexican employment landscape, and employers must ensure that they comply with all regulations related to social security contributions. Employers who prioritize social security contributions can benefit from a motivated and productive workforce, ultimately leading to business growth and success.

What employee benefits are required in Mexico?

Federal Labor Law mandates a number of benefits, including paid time off for federal holidays and paid vacation time. Certain bonuses are also mandated. For example, employees in Mexico receive a year-end bonus known as Aguinaldo, distributed in December. This “Christmas bonus” equates to at least 15 days’ wages for employees who worked for the full year. In addition, companies operating in Mexico are required to distribute 10% of pretax earnings among employees.

Beyond these legally mandated benefits, many companies find they gain a competitive advantage by extending additional benefits. As a result, it often helps to work with an HR expert knowledgeable in the region in which your factory is located. These experts can advise on additional benefits that can attract quality candidates and limit costly turnover.

Labor relations in Mexico

The Mexican Federal Labor Law sets out two types of employment relationships: individual and collective. An individual employment relationship is created when a person is hired to perform the required job duties and signs an employment agreement. A collective employment relationship is established when the employees are represented by a labor union; in these instances, the point of contact is with the union.

Written employment agreements are mandatory in Mexico. Should employees begin work before they have formally signed an agreement, they are still afforded protections outlined by the Federal Labor Law. Employment agreements are an obligation of the employer in Mexico. Any such agreement must be made available to the employee.

Unless the employment agreement specifies otherwise, the employment relationship is established for an indefinite period. The agreement must also include details on any allowed probationary period, specific services to be rendered, the length of the work day, and salary agreements.

Mexico’s labor unions

The 2019 overhaul of the Federal Labor Law Reforms brought about significant changes to how labor unions operate in Mexico. Previously, companies in Mexico could recognize a union and sign a contract with them without any input from workers, and in some cases, even before the company hired any workers. These "Protection Agreements" often contained employer-friendly contract terms, and few unions provided consistent democratic processes to their members as a result.

However, under the changes set out in 2019, unions in Mexico can now only be recognized as the exclusive bargaining representative with 30% employee support. This means that if a union is able to gather support from at least 30% of the workforce, they can be recognized as the sole representative of all workers in collective bargaining negotiations. This change is meant to prevent employer-friendly Protection Agreements and promote more democratic processes in labor unions.

Moreover, ratification of a collective bargaining agreement now requires the majority support of all represented workers. This means that all workers must be given the opportunity to vote on the proposed agreement, and the agreement can only be ratified if it receives the majority support of all workers represented by that union. This change further promotes democratic processes in labor unions and ensures that all workers have a say in their collective bargaining agreements.

In addition to these changes, the updated law also aims to ensure that employees are aware of their rights. Unions are now required to make physical or electronic copies of collective bargaining agreements available to all members, ensuring that workers can easily access and understand the terms of their collective bargaining agreements. Furthermore, an office at the Federal Center for Conciliation and Labor Registry is required to provide free information to workers about their rights, ensuring that workers are empowered to assert their rights and hold their employers and unions accountable.

Overall, these changes aim to promote more democratic processes in labor unions and ensure that workers are empowered and informed about their rights. By promoting transparency and accountability in labor unions, these changes ultimately benefit both workers and employers, leading to more productive and harmonious workplace relationships.

Terminating workers in Mexico

Terminating employees in Mexico requires employers to provide a valid reason for termination, as there is no "at-will" employment in the country. Even though there is no requirement for a notice period, the employer must issue a written statement that outlines the cause of the dismissal within one month after the causal event. In the case of collective employees, the union may impose additional restrictions on dismissals.

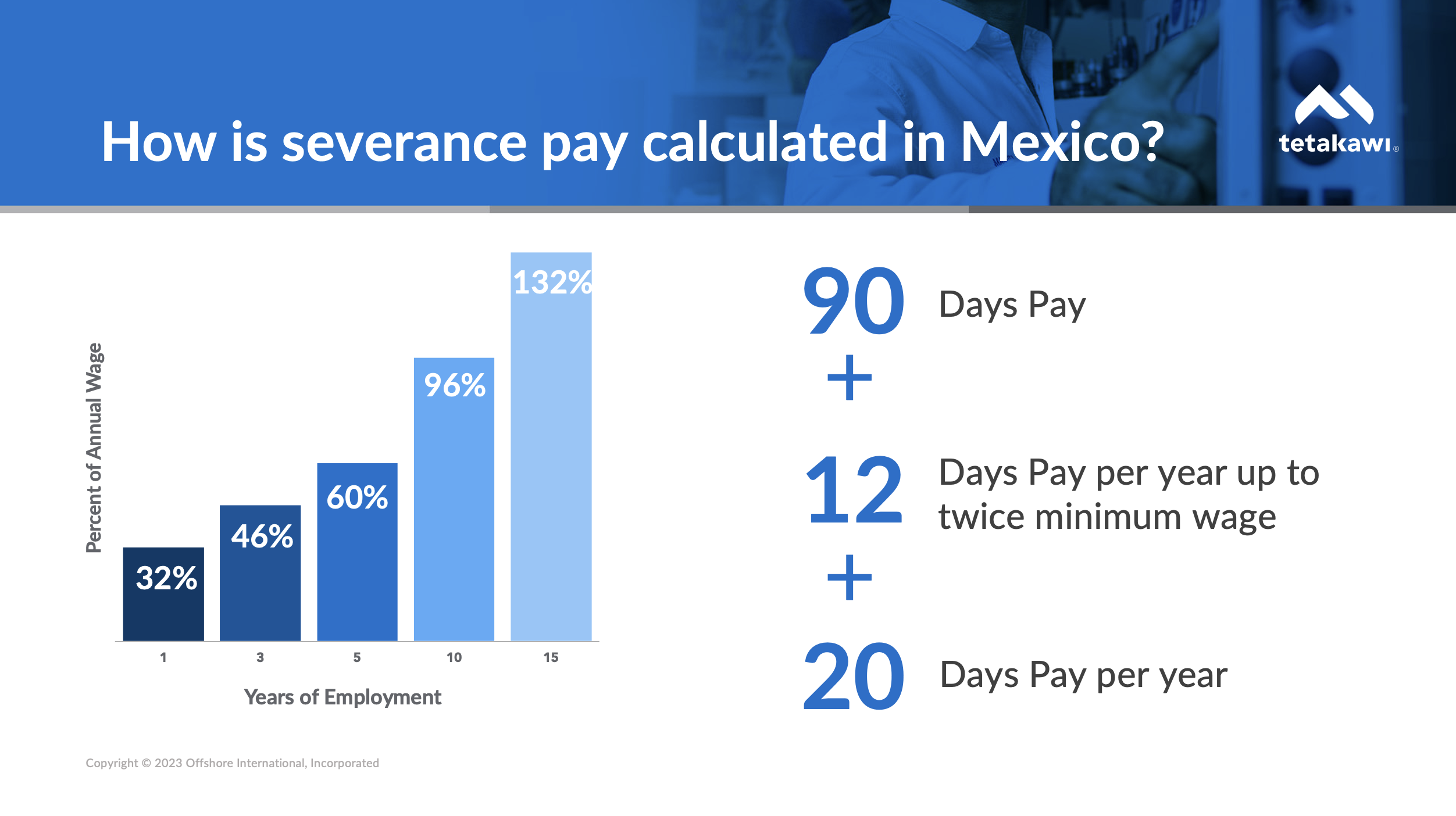

Employees who are on indefinite contracts are eligible for a severance package, which will vary depending on the reason for termination. In order to ensure that they receive fair compensation, employers should document the cause for termination thoroughly. If an employee is fired without a valid reason, they may be entitled to a severance package that includes three months or more salary, as well as bonuses for seniority, accrued vacation, and other payments specified in the employment agreement. By following the proper procedures for termination, employers can maintain positive relationships with their employees and avoid legal disputes.

Compliance with Mexico employment laws

Employers who are new to operating in Mexico often encounter nuanced differences between Mexico's labor laws and those in the U.S., Canada, Europe, or China. These seemingly small details can have significant consequences and lead to major fines if not properly addressed. Like the United States and most other developed countries, Mexico actively enforces employment laws against companies, including foreign investors. The U.S. Department of Labor even supports the training of labor inspectors in Mexico to ensure compliance with the terms of the USMCA free trade agreement.

In light of these challenges, many manufacturing companies opt to partner with shelter service providers like Tetakawi. Such a partnership provides companies with the essential expertise and support needed to navigate the intricacies of Mexican labor laws. Tetakawi’s knowledge in this area is invaluable, helping companies avoid missteps and ensuring adherence to local regulations. This not only mitigates the risk of fines and legal complications but also streamlines the administrative process, allowing companies to concentrate on their core operations. Tetakawi’s services prove to be an asset for foreign companies, creating a hassle-free experience in maintaining compliance with Mexican labor laws.

For a more in-depth insight into Mexico’s labor laws, download our free ebook, Your Guide to Understanding Mexican Labor Law, or contact Tetakawi today.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.