The recent uptick in Mexican manufacturing is not independently self-sufficient, but works as a catalyst for U.S. economic growth. Both sides of the border contribute to the production and consumption of goods that enable productivity and job growth for both countries. “Mexico is in the throes of a manufacturing boom” writes Natalie Kitroeff for the LA Times. There are various factors contributing to Mexico’s “manufacturing boom” such as free trade agreements, a mature labor force, and access to large markets. These factors support high skilled U.S. jobs, North American trade, and U.S. economic gains.

U.S. and Mexico Manufacturing Partnership

The current political rhetoric in the U.S. criticizes NAFTA’s efforts and villainizes its impact on the U.S. but, according to the Peterson Institute for International Economics (PIIE), about 20 million U.S. jobs depend on trade with Mexico, which creates higher productivity and lower consumer prices. The collaboration between U.S and Mexico has allowed manufacturing on both sides of the border to advance and maintain a bi-national production process. For instance, according to the Mexico Institute at the Woodrow Wilson Center, the U.S. produces over 40% of the materials used in finished Mexican products. This 40% helps maintain Mexico’s place as one of the U.S.’s biggest export partners, and, Kitroeff notes, is much higher than the 4% of U.S. materials being exported to China.

North American Manufacturing

One of NAFTA’s goals was to ease U.S. border regulation between Mexico and Canada, for a stronger North American continent. Mexico’s “manufacturing boom” has enabled North America to thrive on collaborative efforts in trade, infrastructure, and regulations. The top exports for all three countries - Machines, engines, pumps; Electronic equipment; Vehicles - fall within the manufacturing industry. Instead of competing against Mexico for import / export gains, the implementation of a joined process in the manufacturing realm has enabled economic growth for the U.S., Mexico, and Canada. All three countries implemented changes to their manufacturing industries, which enabled Mexico to attract FDI and grow economically.

Investment in Mexican Infrastructure

Mexico has been able to pull itself out of an economic and social slump by bringing regulation change through continued support from NAFTA. Mexico’s investment in their infrastructure garners great support for investment in manufacturing. For example, the 2014-2018 Infrastructure Reform promises to use 598 billion dollars to implement 743 infrastructure projects. 262 of those projects will be focused on energy improvements, and 233 projects are catered towards communications and transportation. Increased productivity, accessibility, and transport will build the maquila workforce and enable more skilled laborers to accrue necessary knowledge about industrial culture. As the Mexican infrastructure strengthens, maquila workers are able to contribute to their growing economy and make room for an up-and-coming middle class.

Mexican Quality of Life

Mexico has an educated workforce with the ability to surpass traditional maquiladoras and work with advanced mechanical operations. Young professionals benefit from manufacturing jobs and hold positions such as factory workers, programmers, and operations management positions. Mexican workers are provided with opportunities to succeed in their careers, as heightened manufacturing production maintains the country’s growing exports. With a new social status, Mexican quality of life improves and more attention is given to work as the middle class contributes to the Mexican economy. But good news for the new Mexican middle class is also good news for the U.S. labor force.

U.S. and Mexican Labor Force

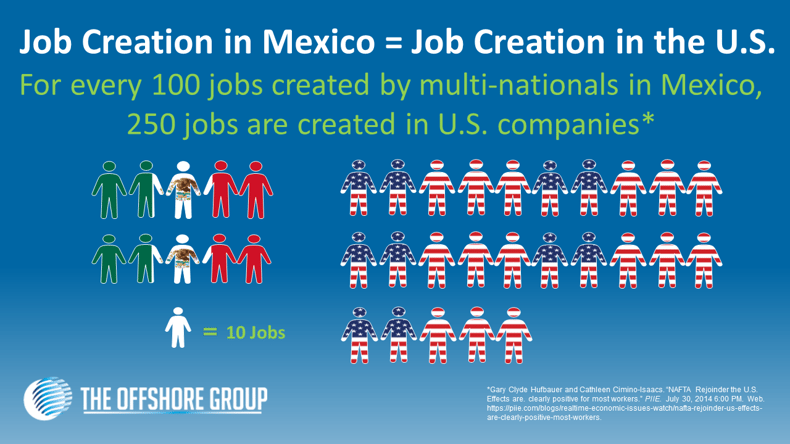

The U.S. is also experiencing a shift in its labor force. U.S. factories have begun to adopt advanced technology systems where high skilled workers are needed to manage and program machines. Educated and high-skilled U.S. workers are in need of jobs and advancements in technology support this need — and pay more. According to a 2014 study by researchers at PIIE, “on average, for every 100 jobs US manufacturing multinational corporations created in Mexican plants, nearly 250 jobs were added in their US operations.” Mexican maquilas continue to grow and contribute to their middle class, which enables companies to create jobs for higher paying positions in the U.S.

Manufacturing in Mexico continues to flourish, and in turn the U.S. manufacturing industry benefits. As 40% of U.S. materials are found in exported Mexican products, the collaboration initiates development on both sides of the border. The growth of the U.S. and Mexican partnership also benefits Canada as its geographic proximity and free trade agreement (NAFTA) play a prominent role. An improved Mexican infrastructure pushes its workers into the middle class to cultivate skills and industry knowledge. The shift to high-skilled or programing tasks offered by U.S. manufacturing companies helps maintain a competitive workforce. The U.S. and Mexico are expected to continue experiencing economic growth in the future as they work together on a national, continental, and global level.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.