While manufacturing in Mexico is an attractive option for many American and other nations’ companies, it takes knowledge, focus and reliable manufacturing cost-model analysis to determine viability, one expert notes.

Eduardo Saavedra is vice president of business development for The Offshore Group. Established in 1986, The Offshore Group has enabled executives in the automotive, aerospace, electronics and other manufacturing specialties to establish professional production locations under its Mexico shelter plan and its Mexican industrial real estate, leading to high-quality, low-cost and low-risk production to improve their global competitiveness.

The Journal of Commerce notes that Mexico had the lowest landed costs for U.S. importers last year (2011), making it a more attractive manufacturing venue than China, where escalating wages and freight are key concerns for American companies seeking to initiate and maintain cost effective locations. Still, cost modeling – or estimating operating expenses for a manufacturing company is not only of critical importance to the start-up phase of operations, but it is also necessary for the successful maintenance of long-term operations. Performing the exercise is an imperative first step for an American company considering a move to Mexico manufacturing, Saavedra affirms.

The Offshore Group’s manufacturing cost model analysis satisfies three main requirements:

First, it takes into consideration every cost that can or will be incurred when doing business in Mexico, from fixed costs like rent or phone services to variable expenses like employee severance or freight charges for goods moved across the border when shipping to Mexico. Next, by benchmarking labor, utilities and logistics costs, of existing firms in relevant industries, the manufacturing cost model contains highly reliable figures. The Offshore Group can deliver a true cost estimate to companies interested in manufacturing in Mexico. Finally, the Mexico cost model’s flexibility allows a company to examine various scenarios – such as utilizing 80 versus 150 employees, while factor in variables like skill levels.

“We express figures in U.S. dollars based on a peso-to-dollar exchange rate that we all agree on,” Saavedra further explains. “If a company’s executives want to be conservative, we can help them to reflect this in how we go about forecasting. If they want to vary the figure, we can change the calculation. When running these Mexican manufacturing cost scenarios, the possibilities are endless, all bases can be covered”

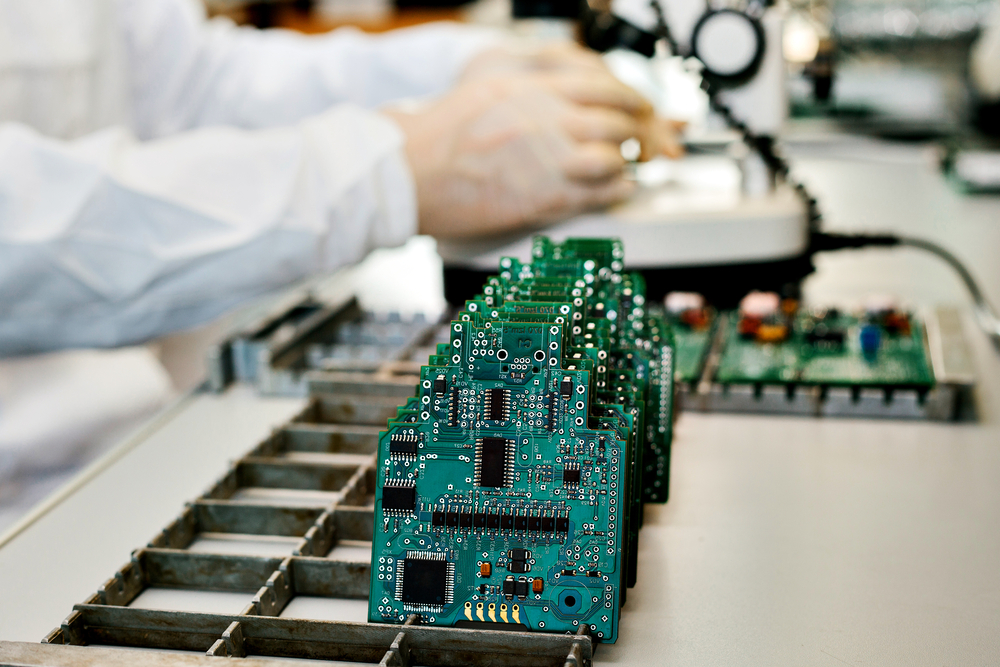

Saavedra notes The Offshore Group has conducted hundreds of cost models for large multinational manufacturers and publicly traded companies as well as smaller, privately-owned firms. The model has worked equally well with manufacturers focused on automotive, aerospace, medical devices and electronics manufacturing services (EMS) as with plastic injection and metal forming and stamping, he says.

Depending on the complexity of their scenarios, manufacturers considering a move to Mexico can meet with The Offshore Group’s expert staff and have most of their questions answered during a two-hour consult, Saavedra says. Such a meeting typically occurs in one of The Offshore Group’s Mexico manufacturing locations, where a tour of a facility starts the conversation and sparks questions relating to the guest’s enterprise.

“When we roll up our sleeves and get down to financial ‘brass tacks,’ we closely examine all items that will, and could potentially, impact Mexican manufacturing costs,” he explains. “This is not a casual exercise of sitting down and going through a series of numbers. It is a case of using real-world benchmarking figures and applying them to specifically projected situations.”

Because of this, the company’s success in accurately providing cost analyses has come to bear with the vast majority of its clients, Saavedra says.

While there are many important – and costly – components of building a business, a 2009 Area Development Corporate Survey shows executives placed labor costs as the No. 1 site-selection factor. And the most recent Bureau of Labor Statistics comparisons show a Mexican laborer earned on averaged a fully burden wage of $6.23 to an American worker’s hourly wage of $34.74 in 2010. (“Fully burdened” figures include pay for time worked as well as allowances for social insurance – which covers issues such as sick leave, severance pay, health insurance, disability and other social-insurance expenditures – and directly paid benefits like vacation time and bonuses.)

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.