When the choice to seek a low cost manufacturing location has been made, it is essential to remember that not only are some activities transferred, but factors of production areas well. These include: people, facilities, equipment, technology, and other assets used in the manufacture of a product. It is imperative to choose the low cost and low risk alternative that enables maximization of profits without jeopardizing credibility and reputation.

Since China first began to make its presence strongly felt on the world manufacturing stage roughly a decade ago, the near universal view has been that China’s inexpensive labor and production capability were no far superior to Mexico’s manufacturing export sector. China has established itself as a manufacturing dynamo, prominent across an extensive array of industries. Nonetheless, Mexico’s disadvantage has been steadily fading. When comparing China and Mexico, Mexico seems to have gained advantage in many important ways. Mexico’s prosperous economy and activated industrial sector have aroused the attention of international corporations. Leading international companies continue to expand their market by building and operating their offshore manufacturing capacity in Mexico. These companies are achieving success in reducing their costs to operate, expanding their market shares, and maintaining the quality of their production. Not only is Mexico holding strong against China, it’s now trending towards advancing its market share of total US imports.

According to studies performed by HSBC Global Research, FDI into Mexico has fully recovered from the post-2008 decline and it’s anticipated that continued strength in manufacturing of automobiles and aerospace components and parts will keep up with the U.S. and world demand. Given growing exports, HSBC expects Mexico to displace China as the top U.S. trading partner by 2018, especially as China’s labor cost advantage diminishes. It is also estimated that Mexico’s exports plus imports could reach 69% of GDP in 2012 and 85% by 2017.

Since 2009, among the major US trading partners, Mexico has been the only country that has gained a significant market share, while the rest of these trade partners, including China, have lost ground. The Chinese share of US imports declined to from 19% to 18% in 2011. The estimated U.S. import gains for the Mexico as regards the US market are projected to be 0.5% to 1% per year for the foreseeable future. This means that if China loses between 1% and 2% in market share over the next six to eight years as the result of its loss of competitiveness in wages and exchange rate, as from rising transportation costs, Mexico could catch up with China and Canada. The United States’ southern neighbor could become the top US trading partner, with a market share at about 16.0% of US imports by 2019.

Mexico’s growing manufacturing success can be attributed to several factors:

• China’s Rising Wages – Wage inflation in China and wage inertia in Mexico have combined to close to gap significantly.

• Neighboring USA –Mexico’s geographic advantage and proximity to the US suggest reduced transportation and logistics costs when compared with those related to trade with China.

• Maquiladora Industry Refinement – Mexico has transitioned from a simple assembler to an exceedingly sophisticated manufacturer. This change can be attributed to the quality workforce—Mexico has the highest percentage of students pursuing engineering degrees in Latin America. Mexico’s numerous trade agreements also give it another competitive advantage.

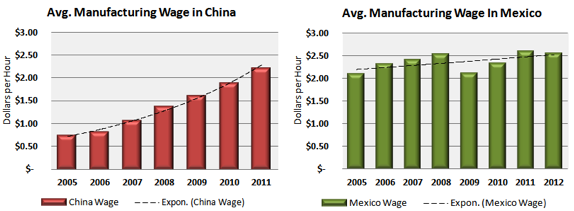

Decreasing Mexico - China Wage Gap

The graphics below demonstrate the decreasing wage gap between labor in China versus labor in Mexico. They demonstrate the consistency of wages in Mexico versus rising wages China.

While Mexican wages were 237 percent higher than Chinese pay in 2002, this figure has been reduced to an estimated 14% today. Chinese worker wages are expected to surpass those of their Mexican counterparts within the next few years. Mexico’s fully loaded manufacturing salaries registered US$2.10 per hour in 2011 up from US$1.72 in 2001, a 19% increase. In contrast, China had an average wage at US$1.63 in 2011 from US$0.35 in 2001. The increase has been almost fourfold.

In addition, Mexico’s labor market still holds a level of slack, which indicates that there is ample workforce availability for future job creation. HSBC believes that Mexico labor availability indicates that Mexican salary growth will remain modest, contributing to a further reduction in the difference between Mexico and China’s salaries.

Strategic Location

A key factor that affects competitiveness is the existence of an effective supply chain that has access to quality inputs at reasonable prices. Also, inputs to production must arrive at their destination in timely fashion, or “just in time.” Shipping times are significantly less between Mexico and the U.S. versus China and the U.S. Shorter shipping times in turn represents lesser transport expenses. This is important for two reasons, firstly, because fuel prices are increasingly volatile; and secondly, quality issues are more easily resolved. It is less cumbersome and more efficient to send products back to Mexico for reprocessing, whereas if there are quality issues from China, the cost to ship the product back for reprocessing may be more than the cost of the producing the item in the first place. Low transportation costs in Mexico are the result of shorter distance to U.S., Canadian and Latin American markets.

Sophisticated Industry Advantages in Mexico

Skilled, educated workers in Mexico are plentiful. Relatively high birth rates provide a sense of security that labor will continue to be plentiful. China also has a highly-qualified population of workers, but low birth rates suggest a diminishing access to qualified workers in China over time.

Mexico has also diversified its trade relationships beyond North America, having negotiated free trade or commercial agreements with 44 countries since the 90s. These countries represent two-thirds of global GDP, and include the most important countries in the world with the exception of China, India, and Brazil. With respect to Brazil, efforts are ongoing at trying to craft a free trade accord between Latin America’s two largest economies. Mexico is the country with the largest number of free trade agreements in the world.

Recent Noteworthy Investments in Mexico

Automotive:

• Fiat’s recent $550 million investment in the Fiat 500 production line in Mexico, expected to produce 120,000 vehicles a year.

• Mazda (Japanese auto company) invested US$500 million in Mexican auto in Guanajuato.

• German luxury automaker Audi will build its first manufacturing plant in Mexico by 2016. Estimated to cost about US$2 billion.

• U.S. automaker Ford will invest US$1.3 billion to expand capacity at the company’s production facility in the northern Mexico city of Hermosillo.

• Korean automaker Hyundai Motors began construction on a new manufacturing plant in the northern city of Tijuana, on the Mexican border with California. The US$131 million facility is planned to produce die cast aluminum parts such as engine blocks, heads, and transmission cases.

• U.S. automaker General Motors announced it will invest US$120 million in its manufacturing plant in the central state of San Luís Potosí to produce its new Chevrolet Trax SUV crossover model, to be unveiled later this year at the Paris Motor Show. Another US$200 million will be concentrated into the GM plant in Guanajuato state to develop and produce a new generation of pickups in 2013.

Research and Development:

• U.S. corporate group 3M unveiled a new Innovation Center in Mexico City’s Santa Fe business district. The center, part of planned 3M investments totaling US$184 million over the next five years, will carry out research and product development in areas such as nanotechnology, specialized materials, biotechnology and electro mechanics, the company reported.

• U.S. corporate group General Electric will invest US$30million to expand its Advanced Turbo Machinery Engineering Center in the central Mexican state of Querétaro. The center develops software for GE’s aviation and energy divisions.

Aviation:

• Mexican airline startup AeroJal announced it will launched regional passenger service in the west and northwest of Mexico this year. The company will invest US$30 million to begin direct flights from Guadalajara to regional centers in the states of Sonora, Chihuahua, Coahuila and Nuevo León.

• Canadian aviation simulation and training firm CAE Inc. inaugurated a new flight simulation and training center at the Toluca international airport near Mexico City. The US$50 million facility includes full flight simulators for Learjet aircraft and the Bell 412 helicopter.

• U.S.-based coatings engineers Ellison Surface Technologies will open a new thermal spray coating and special process facility in the northern state of Sonora, the company announced at the Farnborough air show. The US$1.5 million location is planned to provide heat treatment and special processes for aerospace component.

Manufacturing in Mexico:

• U.S. industrial gas producer Paxair will invest US$100 million to build a new manufacturing plant in the northern state of Coahuila. The facility is planned to produce oxygen, nitrogen, and argon for the steel, metal forming, glass and automotive industries in the region.

• Japanese-owned automotive accessory manufacturing Viam Manufacturing Inc. announced it will invest US$40 million to build a new production facility in the central state of Aguascalientes. The plant is planned to produce floor mats for its principal client, Nissan, which earlier this year announced plans to build its third manufacturing plant in Mexico.

• German auto parts maker Robert Bosch plans investment of approximately US$140 million in its Mexico operations this year, based on projected domestic sales growth of 10-15%. The company operates eight manufacturing plants around Mexico

Energy:

• U.S.-based solar technology company SolFocus will lead the development of a major new solar energy generation site in the northern Mexican state of Baja California. Projected to cost of US$1.5 billion and generate 450 Mw.

• Mexico hydroelectric developer Comexhidro and U.S. investment firm Conduit Capital Partners will team up to develop a 22 Mw wind generation facility in the northeastern Mexican state of Nuevo León. This plant is planned to use eight General Electric turbines and provide electricity for public lighting in the municipality of Santa Catarina.

Consumer Goods:

• British-Dutch Consumer goods multinational Unilever will invest US$500 million in Mexico by the end of 2015

There are still challenges to overcome for Mexico in order to eclipse China as the largest supplier of manufactured goods to the United States. Among them are security issues and overwhelmed border crossing infrastructure. The present government has identified these to be priority areas which must be addressed in order for Mexico to continue to move its economy forward.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.