State-owned China Communications Construction Company has announced preliminary plans to build an industrial park in Mexico, Reuters reported. The new venture is projected to become one of the largest Chinese investments in Mexico, which is currently Latin America's second-largest economy.

The government of the western state of Jalisco and Liu Yeuping, the America chief of CCCC, signed an agreement in the state's capital to develop the park. The new investment could award China a major foothold in Latin America that will help its manufacturers supply the high-demand North American market.

According to Reuters, both Guadalajara, Jalisco and CCCC have agreed to conduct a six-month feasibility study to identify the best location for the project. Additionally, the study will bring two Chinese officials into the country to determine which manufacturing companies should participate.

Jalisco officials are hopeful the industrial park will draw dozens of manufacturers to Mexico.

"Jalisco officials are hopeful the industrial park will draw dozens of manufacturers to Mexico."

"This is going to be a key source of jobs that will have an impact not just in our state, but also nationally," Governor Aristoteles Sandoval of Jalisco said.

Reuters noted according to Jalisco officials, the size of the Chinese investment, the diversity of companies that join the park and its actual location are dependent on the results of the feasibility study.

Additionally, Reuters reported that if the project in Jalisco succeeds, it will help mend economic relations between Mexico and China, which were damaged last year when President Enrique Nieto canceled a $3.75 billion Chinese led high-speed rail contract.

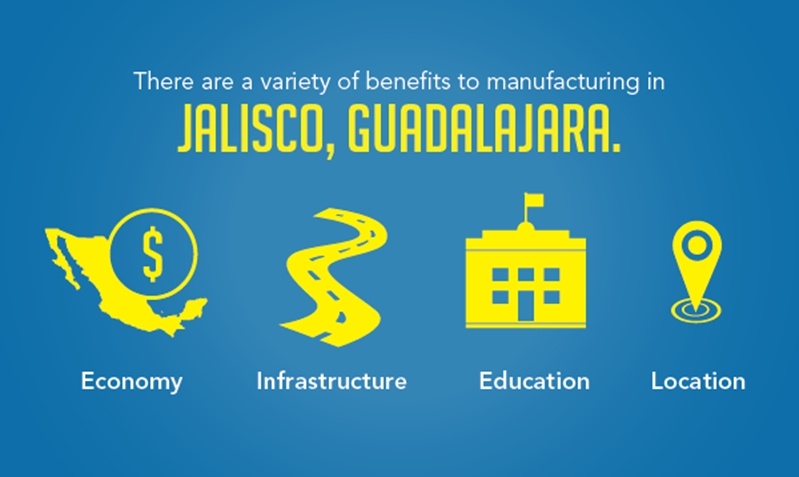

Why Jalisco, Guadalajara?

With such a large investment underway, CCCC is no doubt tapping into the offshoring advantages of manufacturing in Mexico, and more specifically, the strategic benefits of Jalisco in particular. There are a variety of benefits to manufacturing in the region:

- Economy: Manufacturing has been the main driver of economic growth and the basis for Guadalajara's national importance. In fact, manufacturing activities employ about one-third of the population there. More specifically, Guadalajara is the third-largest economy in Mexico and has excellent infrastructures for industrial development.

- Infrastructure: Guadalajara has the advantage of modern highways that lead directly to Mexico City.

- Education: There are over 20 universities in the area and more than 6,500 engineers graduate annually in the area. Innovative programs, government funding and applied research programs all provide a highly skilled workforce for manufacturers in the area. Additionally, the government provides access to certification programs for workers that help make manufacturers more competitive.

- Location: As Reuters pointed out, Guadalajara is positioned strategically between the largest Mexican container port, Manzanillo, and the industrial belt of central Mexico, which is well-connected to the U.S.

What does the move mean for China?

CCCC's decision to open a massive industrial park in Mexico comes as no surprise. In recent years, countries across the globe and especially those with a heavy focus in manufacturing have realized the benefits of expanding to Mexico or moving their operations entirely within the country's borders.

Jalisco, Guadalajara is a prime location for companies like CCCC to manufacture.

Jalisco, Guadalajara is a prime location for companies like CCCC to manufacture.As Reuters reported, between 1999 and 2015, Chinese foreign direct investment in Mexico was $380 million, which was less than Ireland, Puerto Rico and Taiwan combined, and accounted for under 0.1 percent of the total amount. U.S. FDI in the country was much higher, totaling $186 billion. A challenging political environment, the rising cost of labor and distance to high-demand markets that creates a challenge for suppliers are drawing manufacturers away from the area.

However, times have changed and countries like China who used to lead the way in offshore manufacturing are now moving their own business to locations that are more operationally and economically feasible.

In fact, official data from China's National Bureau of Statistics revealed China's manufacturing sector shrunk to a 3-year low in August. Further, China's official manufacturing purchasing-managers index fell to 49.7 in August from 50 in July. While a PMI above 50 signifies growth in the manufacturing sector, a PMI reading below that level represents a decline.

It makes sense, then, that China has decided to invest in a country that will yield it greater profits. By expanding to Mexico, CCCC is in a position to greatly impact China's manufacturing sector and improve its bottom line. According to Reuters, China's rapid economic growth in areas outside of manufacturing over the past two decades has translated to higher labor costs in the country. Now, manufacturers can gain access to skilled labor much more affordably by tapping into Mexico's workforce.

Meanwhile, moves like CCCC's have led to the enormous growth of Mexico's manufacturing sector, which is expected to reach $18 billion by 2018. Additionally, MAPI reported the country will continue to lead manufacturing growth in Latin America through 2016.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.