A couple of blows to the Medical manufacturing industry in North America have radically redefined the needs of the market. Inbound Logistics detailed how business in the U.S. and Mexico struggle to create dependable supply chains after government legislation passed in 2013 redefined the health industry in both countries.

Among the many solutions suggested, nearshoring operations - manufacturing in Mexico and the U.S. as opposed to overseas - seems to be the most promising. Many industry experts advise North American medical manufacturers to move operations closer to home to reduce cost, gain visibility and respond to new demand trends.

A new way of doing business

In 2013, the U.S. passed the Affordable Care Act. The new health coverage laws have been amended several times since then, and each alteration is designed to provide medical care for the general population. This means insurance companies, hospitals and individuals have to prioritize their demand for new products as they look for ways to restructure their finances in light of changing government incentives and restrictions.

New opportunities may provide a boost for Mexican medical manufacturing.

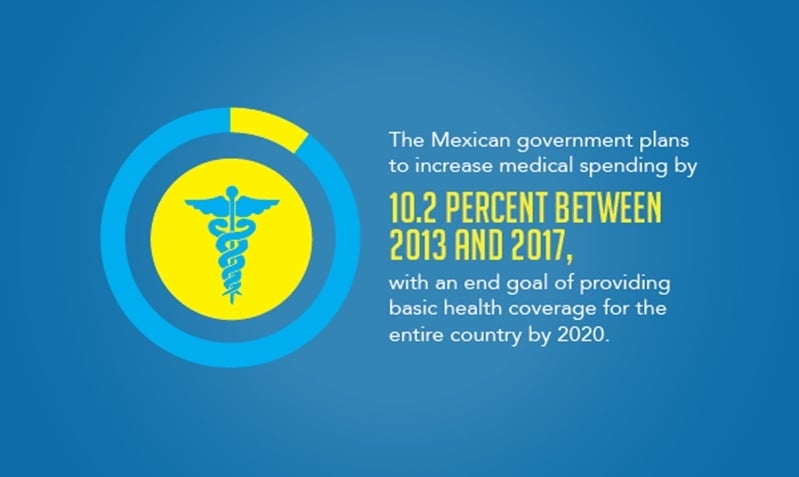

New opportunities may provide a boost for Mexican medical manufacturing.At the same time, the Mexican government plans to increase medical spending by 10.2 percent between 2013 and 2017, with an end goal of providing basic health coverage for the entire country by 2020. This is a huge opportunity for medical manufacturers in the country to produce affordable goods for a growing market. Companies should strive to be the best option for companies and government agencies looking to spend new funds.

Other changes being thrown at the North American health industry include a more health conscious and aging population, excise taxes on medical supply shipments and restrictive tracking regulations.

Looking for opportunities

When redesigning operations to meet demand, the supply chain should be a top priority for medical manufacturers. This is why nearshoring is a popular option for many companies. U.S and Mexico companies often produce goods for local markets and can save money by creating products closer to their clients. U.S. companies often turn to Mexico for shorter supply chains while still obtaining offshoring advantages.

"Companies often turn to Mexico for shorter supply chains."

Eduardo Saavedra, The Offshore Group's executive vice president of business development, told Medical Product Outsourcing that Mexico manufacturing offers U.S. companies reduced labor costs, skilled workers and proximity to consumer markets.

"Staying close to the ultimate consumer has always been and still is an advantage," Saavedra said in a MPO interview. "The proximity of Mexico to the United States and Canada is especially advantageous when not only the ultimate consumer but the supply chain is located near the manufacturing site."

Nearshoring provides closer manufacturing partners. This can prove essential for communication, data exchange and agile production lines. It's important medical manufactures are ready to adjust facility operations to respond to government regulations coming down the road.

Manufacturing facilities in Mexico

While manufacturing in Mexico is a popular option for a variety of industries, the medical community is only beginning to catch on. Plastic News detailed how border communities in Mexico prepare for increasing demand, and facilities are ready for U.S. companies looking for cost-efficient solutions to new health industry demands.

Like many regions in Mexico, Ciudad Juarez has fostered medical manufacturing talent development in local populations and formed local organizations to consolidate resources. A factory in the area recently expanded its operations to meet a growing demand. The facility added three new presses to help continue making products, which it has successfully done since 1999.

If U.S. companies work with shelter services they can easily locate the appropriate skilled labor in a facility located next door to its final consumer group.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

.jpg)