Semiconductors play a pivotal role in virtually every electronics product made today, from smartphones to vehicles to military technology. The microchip’s importance became even more recognized in the face of semiconductor shortages that began in 2020 and continue to be felt in some production areas today.

To mitigate the risk of future semiconductor supply chain challenges, the United States has launched investment in U.S.-based semiconductor production and a partnership with Mexico that the U.S. Department of State says will create a more resilient, secure, and sustainable global semiconductor value chain.

Manufacturers within the semiconductor value chain may find that they can strengthen their production foundation by locating certain activities in Mexico. Below, we explain how Mexico is positioned to support North American semiconductor production and where to locate your operation for success.

Semiconductor production is growing in North America

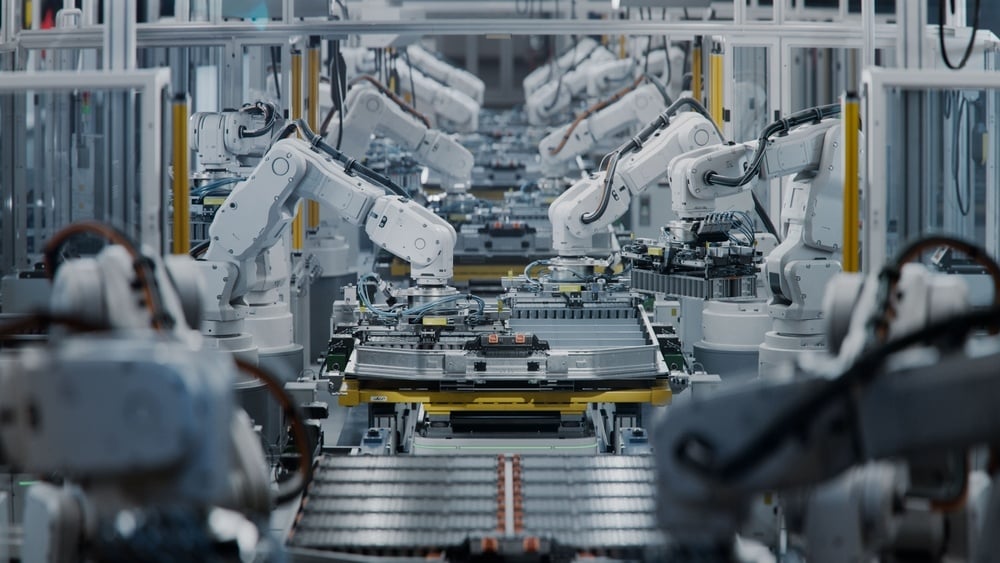

Semiconductor demand has risen sharply in the last decades as electronic components are integrated into more products and industries. Semiconductors are essential for the production of electric vehicles, now produced by virtually every automaker. They are critical for supporting the growth of artificial intelligence. They are intrinsic to a vast range of military technologies.

For decades, Taiwan has been the largest producer of semiconductors in the world, led by TSMC, which produces roughly 90% of advanced semiconductor chips. When a 7.4-magnitude earthquake hit Taiwan in April 2024, it was a stark reminder of the risk of reliance on Taiwanese production of these critical chips. The United States is seeking to offset that type of reliance by investing in North American semiconductor production.

In 2022, the CHIPS and Science Act directed $50 billion in investments to the American semiconductor manufacturing industry and related research and development in order to “strengthen American manufacturing, supply chains, and national security”.

Much of that investment is flowing into Arizona, which has been a site of semiconductor production since the 1940s. Today, it has more than 115 chip-related companies, including Intel and TSMC. The Taiwanese manufacturer announced a $12 billion investment into construction of a Phoenix semiconductor plant in 2020, with plans for additional fabrication plants in the state. Intel broke ground on two new $20 billion semiconductor plants in Chandler, Ariz., in 2021.

However, semiconductor manufacturing is a multi-step process, and companies are finding that it makes sense to locate some of the more labor-intensive steps, such as assembly and packaging, in Mexico. In this way, they can reap cost savings that can be reinvested into research and development or more advanced areas of production.

U.S. and Mexico formalize semiconductor ecosystem support

Arizona and Mexico have a long history of mutual support. Arizona’s manufacturing output has increased steeply over the last decade, particularly in the electronics, aerospace, and transportation sectors. However, the state faces the same challenges as the rest of the nation in developing a skilled labor pipeline to sustain its growth trajectory.

To help fill gaps in this labor pipeline, many Arizona-based companies work closely with suppliers in Mexico or opt to locate certain manufacturing activities in Mexico. Given the average hourly wage differences between unskilled production staff in Arizona versus Mexico – $17.25 in Arizona compared to $4.55 in Mexico – manufacturers stand to gain cost savings that can be reinvested in their Arizona-based operations. In fact, Arizona has supported this move to Mexico with agreements such as Arizona State University's (ASU) commitment to assist higher educational institutions in Mexico with semiconductor manufacturing workforce development.

The U.S. government seems to be taking a similar view of the benefits of sharing semiconductor production activities with Mexico. In April 2024, the U.S. and Mexico formalized their partnership through a semiconductor initiative meant to strengthen and grow the Mexican semiconductor industry. According to the U.S. State Department, this collaboration will support work already underway to bolster regional competitiveness in semiconductors, including workforce development.

Under the agreement, key stakeholders in the Mexican ecosystem, including state governments, educational institutions, research centers, and companies, are participating in an assessment of Mexico’s existing semiconductor ecosystem and regulatory framework, as well as workforce and infrastructure needs.

Where semiconductor suppliers are operating in Mexico

According to The Wall Street Journal, a number of major U.S.-based technology companies have already asked their Taiwanese manufacturing partners to increase production of AI-related hardware, including microchips, in Mexico. Some of these firms, including Foxconn, Pegatron, Wistron, Quanta, Compal, and Inventec, already manufacture in northern Mexico. Popular locations include the cities of Tijuana and Juarez, as well as locations across Chihuahua, Nuevo Leon, and Sonora.

Manufacturers looking to locate portions of their semiconductor production operations in Mexico might find they can balance proximity to supply chain partners with cost savings by looking just south of the northern border zone. This border zone is a formal economic area that commands higher wages and operating costs and sees steeper rates of labor competition and turnover.

Hermosillo, the capital of the state of Sonora, is one promising location. Sonora and Arizona have a longstanding history of mutual economic development. Moreover, Hermosillo has served as a manufacturing center since the 1980s. While its roots are in the automotive industry, it has become a location of choice for advanced manufacturing companies in a range of sectors. The city offers a skilled workforce, strong educational infrastructure, low average wages and real estate costs, and easy connectivity to the Arizona border.

During an ASU semiconductor training event held in Hermosillo, Sonora Gov. Alfonso Durazo explained that six new higher education programs have already been developed to move this sector forward. “We’re going to start the engineer career in the semiconductor industry run by our biggest university, UNISON,” Durazo said. He noted that was the beginning of Sonora’s plan to increase its commitment to education support.

Ready to establish a factory in Mexico to support North America's semiconductor industry?

Hermosillo’s robust manufacturing ecosystem means that it’s easy for companies to start their operations here. By partnering with an experienced shelter provider like Tetakawi, companies can launch operations in as little as 60 days.

The simplest way to launch is within the Rio Sonora Manufacturing Community. This location offers build-to-suite manufacturing space, on-site support services, and amenities tailored to attract and retain your workforce. To learn more about how a shelter provider can simplify your expansion into Mexico, contact Tetakawi today.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.