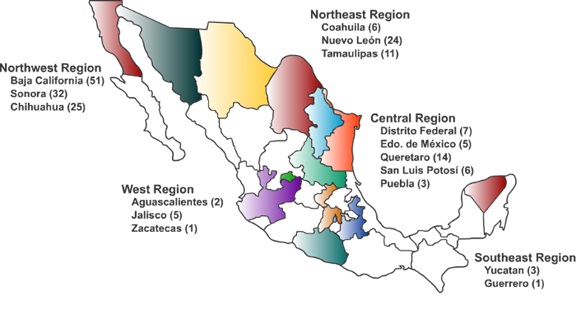

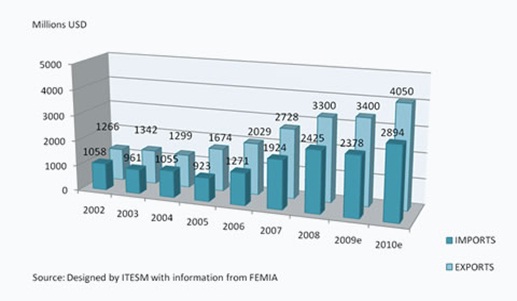

Mexican Aerospace Industry is a relatively new production with notable advancements since 2002. Presently, Mexico embraces over 266 aerospace-related companies (79% manufacturing, 11% MRO, and 10% development and engineering) in 18 states, providing a total of more than 32,000 jobs. Investment, both foreign and direct, is currently around $13.5 billion USD, and there have been 18 known new projects announced in 2011 and 2012 alone. In 2012 there is an anticipated 14% annual growth, and by 2015 it is expected that the industry will employ over 37,000 workers, maintain over 350 companies, and generate $7.5 billion USD with 30% more of national supply. Mexico is the largest FDI recipient in the sector worldwide for the past three years. It is also the 10th largest supplier to the U.S. market, and numbers are constantly improving.

Opportunities in Mexico's Aerospace Industry:

There are large OEMs driving market standards (BOEING and AIRBUS), maintaining the industry “up” cycle. The incremental trend for backlog order in Quarter 1 of 2012 is 7,012 versus an average output capacity of 1,800 aircraft per year. The backlog orders are close to 7 years.

There are medium OEMS (BOMBARDIER (CAN), EMBRAER (BRA), MITSUBISH (JAP), SUKHOI AND IRKUT (RUS), COMAC AND AVIC (CHINA), and they have a 7 year backlog as well.

Private planes and helicopters (CESSNA, HACKER BEECHCRAFT, DASSAULT, GULFSTREAM, GRUMMAN, BELL, SICORSKY, AUGSTA, EUROCOPTER) have 3-year backlog orders.

*The defense market is over 4-5 times the commercial aerospace market, which is approximately $550 billion USD.

Government agencies and FEMIA working together provides many prospects including: recognizing business breaks in specific regions, backing up their words in international events together, developing a National Aerospace Strategic Program to enhance business opportunities, and evaluating the competitive environment to mutually develop attraction for NDI and FDI.

Challenges in Mexico Aerospace:

Challenges that have faced the industry are present despite its success. Some encounters that exist include the following:

- Increasing local capacity for certification in order to attract local companies to the sector has been and continues to be a struggle for the industry.

- A continuous supply of human talent to meet industry needs has also been a challenge, however with a young total population and improving educational opportunities this is decreasing.

- The rationalization of government incentives in engineering and development has proved to be a hitch in the industry’s expansion.

- The optimization regional comparative and competitive advantages including:

o Geographical positioning

o Infrastructure connectivity

o Free Trade Agreements networking

o Same time zones for working

o High capacity to react to new product requirements

o The Wassenar Agreement

- Avoiding the waste of limited resources has proven difficult within the industry, as limited resources are required for many processes within the industry.

“Pro-Aereo” Mexico's National Strategic Program for the Aerospace Industry

FEMIA, with the support of the Mexican government, has created the ‘Pro-AEREO’, a national strategic program of the aerospace industry. This program is based on key strategies, milestones and goals through 2020 as summarized:

Key Strategies:

1. Preferment and improvement of internal and external markets, defining the vocations and creating the instruments to support continuous growth.

2. Strengthen and develop the aerospace industry capabilities with a linked supply chain.

3. Develop local suppliers and encourage cluster development throughout Mexico.

4. The development of the necessary human assets of the industry with well-defined technical and training programs in addition to education-industry links.

5. Development of the necessary technology including specialized clusters, new areas of technology, R&D labs and development of new materials.

6. Development of the public-private programs required to assist the growth of the industry, with an institutional frame, Governmental leadership, incentives and financing, international covenants and including infrastructure, certifications required by the industry, logistics and technical centers.

Milestones in Mexican Aerospace Industry History:

- The establishment of a formal coordination and administrative-management mechanism between industry and government.

- Active manufacturing participation in international programs to access new technologies and markets.

- To enact the establishment of a formal “buy-local” strategic program.

- The establishment and implementation of “offsets” compensation systems to benefit corporations established in the country.

- To create specific support and incentive programs for the aerospace sector.

- An access to specific financial line for the aerospace industry.

- To design, to develop, to manufacture and to assemble an engine module.

- To support the assembly of the first series place with 50% local content.

- To place Mexico as the first aerospace service HUB in Latin America.

Goals through 2020:

- To be within the 10 largest suppliers of the aerospace industry in the world exports.

- To reach over $12 billion USD in exports a year.

- To have over 110,000 workers in the aerospace business.

- To reach 50% of local content in our raw materials and products in the aerospace industry.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.