As December nears, many workers in Mexico eagerly await their annual end-of-year Christmas bonus, also known as aguinaldo. In this post, we’ll review the origins of this fundamental Mexican labor law requirement, who receives it, how to calculate it, and the coming labor law changes that may impact your payments.

Definition of Mexico's aguinaldo bonus

The aguinaldo is an end-of-year payment disbursed to workers in Mexico each December. Also known as “13th-month pay”, this annual holiday “bonus” pay is required by Mexico’s Federal Labor Law.

Mexico’s Federal Labor Law was established in 1930 to improve and protect workers’ rights, benefits, payroll services, and social security, among other issues. Today’s aguinaldo payment developed out of a 1970 reform of this law through the addition of Article 87. That update specifies that each December, workers are entitled to receive holiday bonus pay equivalent to a specific percentage of a worker’s salary.

Given the legal basis for the aguinaldo, it is essential to acknowledge that it is not a Christmas bonus. The aguinaldo is a fundamental legal right. This distinction is important because, unlike bonuses — which can be subjectively based on business agreements, job performance, or benevolence by the employer — the Federal Labor Law governs the payment of the aguinaldo.

Who is eligible to receive an aguinaldo in Mexico?

Every employee in Mexico is eligible to receive an aguinaldo. From domestic workers to executives, employee contract type has no bearing on whether or not an employee will receive an aguinaldo. Regardless of status, every person employed by a company or business in Mexico has the right to this protected benefit.

The sole exclusion to aguinaldo recipients is freelancers. Typically, freelancers are self-employed contractors and not part of a company’s established payroll.

In the event of an employee’s death, the Aguinaldo benefit is disbursed to the employee’s dedicated beneficiaries. This is also legally mandated. If a company chooses not to adhere to the law, it may face lawsuits or other legal liability at the local and federal levels.

How Christmas bonus pay can boost retention

The aguinaldo payment is one of the most essential rights workers have in Mexico. But aside from its legal standing, the aguinaldo can also be a boon to employee retention. Contract employees sometimes lack the opportunity for subjective bonuses and other benefits, especially at lower levels in the organization, but the aguinaldo is something all workers can receive and enjoy.

The aguinaldo provides additional income to employees during a time of the year when money can seem short. Many workers count on the annual aguinaldo to pay down debt at the end of the year, save for a rainy day, or bring a bit of cheer to the holiday season. This payment can help employees feel that their hard work is appreciated and adequately compensated.

How much is the Christmas bonus worth?

Currently, an aguinaldo payment is equivalent to the following:

- A minimum of 15 days of salary, or

- A sum proportional to the time someone has worked for the company

The 15-day minimum includes national holidays, as well as any doctor-approved sick days, which must be verified by the Mexican Social Security Institute. In addition, employees who do not work for an entire year must be compensated based on an amount proportional to their time in their position.

Legislation currently working through Congress has proposed doubling the required 15 days of wages to 30 days’ wages. However, for retention purposes, many industrial companies already pay the aguinaldo as an extra full month’s salary (30 days). In fact, this is why the aguinaldo payment is also known as “13th month pay.” At present, this amount is subject to negotiation between the employer and the employee. As legislation moves through Congress, companies will want to pay attention to updates or work with an experienced payroll administrator in Mexico.

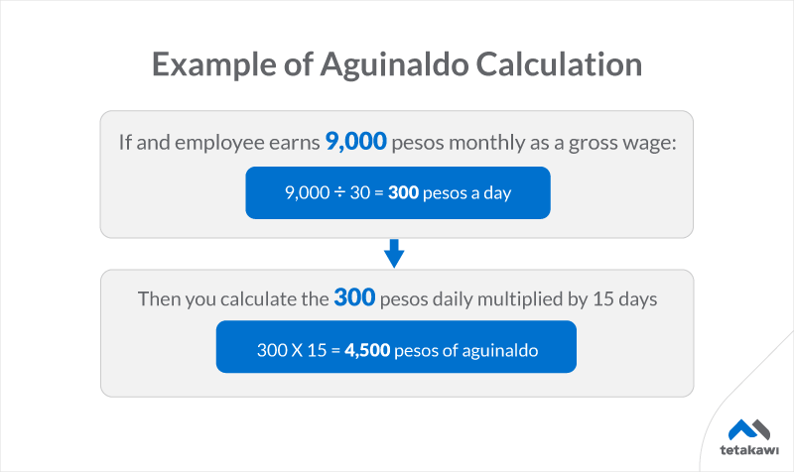

How to calculate the aguinaldo Christmas bonus for employees in Mexico

To calculate the Christmas bonus, multiply the employee’s daily wage value by the 15-day minimum.

Aguinaldo = Daily Payment x 15 Days

The final value of an aguinaldo payment varies based on each employee’s calculated daily payment. The values used for that calculation will depend on each employee’s contract. Daily wage contracts are calculated differently for workers on hourly contracts. In a daily employee’s contract, the wage is predetermined. For an hourly worker, salary can vary drastically from day to day based on the amount of time worked. In this case, the daily wage calculation is based on total earnings divided by the number of days in a year (365, or the total amount of days that employee worked that year).

In summary:

- For workers with a daily wage contract: Daily Payment = Daily Wage

- For workers with an hourly wage contract: Daily Payment = (Hourly Wage x Total Hours) / Total # Days Worked

Aguinaldo payment calculator

To help companies estimate the legally mandated aguinaldo payment for employees in Mexico, Tetakawi has created an online aguinaldo payment calculator. Please keep in mind that the results provided here are an approximation of the payment owed. For a more detailed breakdown, we recommend that you talk to your HR team or a payroll outsourcing company in Mexico.

Employee's Monthly Salary in MXN:

Monthly Salary: Result

Daily Salary: Result

Aguinaldo: Result

When is the aguinaldo payment deadline?

As previously mentioned, the aguinaldo must be disbursed no later than December 20th. No situation excuses an employer from payment to employees. For example, these benefits must be fulfilled whether or not a company is facing economic problems.

To learn more about the aguinaldo and how to calculate this legally mandated benefit properly, contact a Tetakawi expert.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

Table of Contents:

- Definition of Mexico's aguinaldo bonus

- Who is eligible to receive an aguinaldo in Mexico?

- How Christmas bonus pay can boost retention

- How much is the Christmas bonus worth?

- How to calculate the aguinaldo Christmas bonus for employees in Mexico

- Aguinaldo payment calculator

- When is the aguinaldo payment deadline?