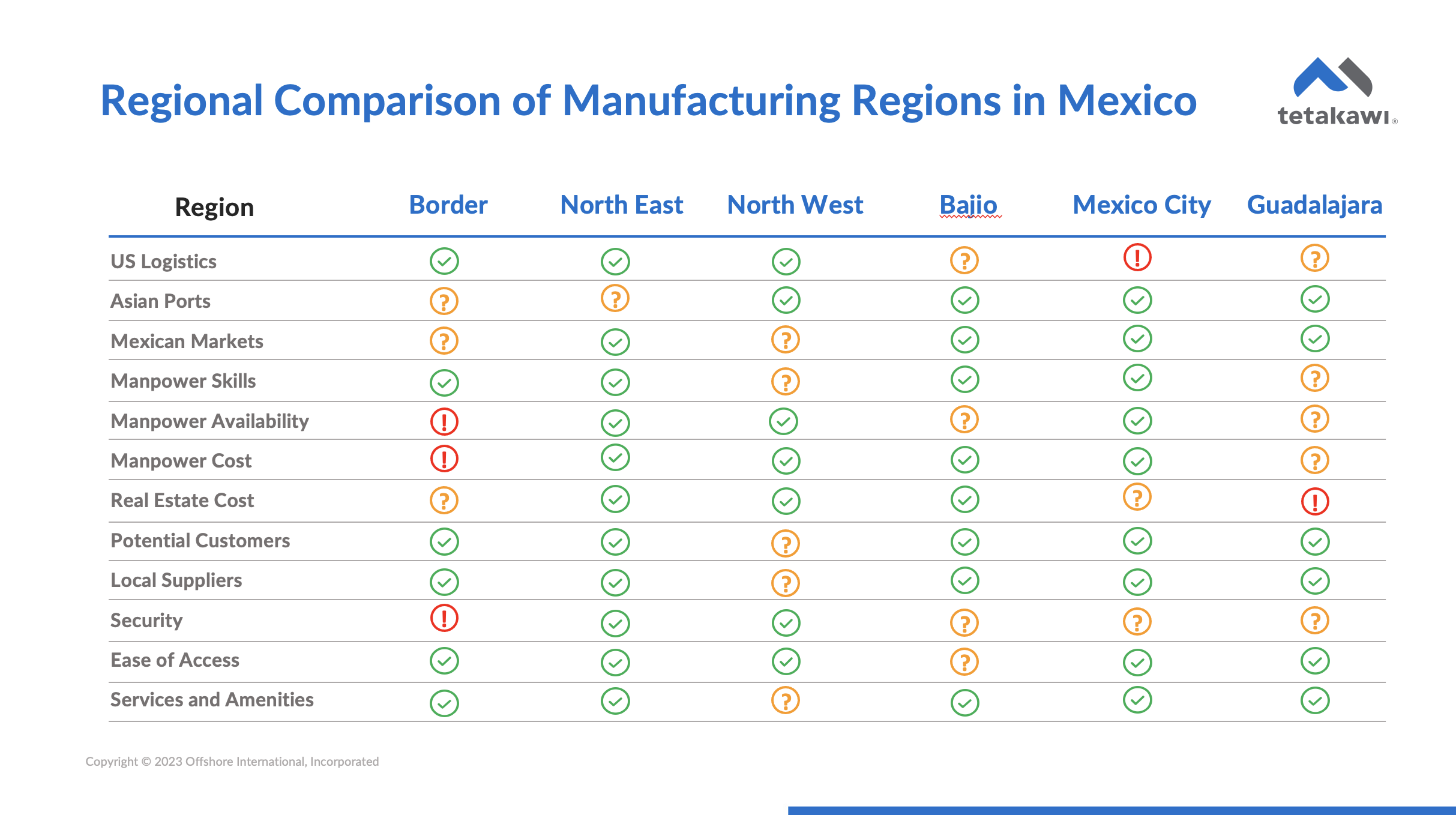

If you’ve decided a Mexico location is right for your manufacturing operation, then it’s time to delve deeper into regional advantages and disadvantages. With a big-picture perspective of Mexico’s six industrialized regions, companies can begin to narrow down their list. This will make the ultimate site selection process much more manageable.

Below, we highlight important criteria to take into account when considering potential sites and the regions in Mexico that are attracting manufacturers today.

For more insight, check out our podcast on site selection, part of the Manufacturing in Mexico podcast series. You can also listen to it here:

7 Factors to drive your Mexico site selection decisions

These are unique for each company, but each of these factors must be considered:

- Customers: Where are your current customers located? What future customers would you like to reach? Where are current raw material sources located, and are there any new material suppliers or vendors from which you could source?

- Manpower: Can you get enough manpower today and in the future? How competitive is the local labor market? Will your new hires have the skills you need, or will you need to invest in training solutions?

- Services: What services are available? Will you need local professional services or access to certain services in the U.S.?

- Cost: What are the typical local wages? What kind of benefits package would you have to offer to be competitive and retain talent? How expansive is local real estate?

- Security: Are there localized security risks that could be a problem? Will people be afraid to come to work? Would your assets be at risk?

- Logistics and accessibility: Can you easily get to the site? Or is it complicated, time-consuming, and onerous to travel back and forth to the site? Will it be difficult or costly to transport goods in and out?

- Appeal: Often overlooked, it’s important to remember that your executive team has a high potential to spend at least the first few years traveling to this location. Is this somewhere you want to go, where you can enjoy yourself and relax while being productive?

Six regions in Mexico to consider:

There are a lot of variations within each area of Mexico, but in general, it is possible to divide the industrialized reaches of the country into six areas. Manufacturers can narrow their search considerably by evaluating the pros and cons of the regions listed below.

1. The Border Zone

The border zone is an area that stretches roughly one hundred kilometers or less south of the U.S.-Mexico border. Cities include Tijuana, Mexicali, Nogales, Juarez, Nuevo Laredo and Reynosa.

Benefits:

- The border’s proximity to U.S. customers, services, and suppliers is tremendously beneficial for some companies.

- Many of these cities have been industrialized for some time, which drives up the availability of high-quality services and strong manufacturing skillsets.

Drawbacks:

- Because these regions have been industrialized for a long time, there’s steep competition for labor, higher operating costs, and more costly services and real estate.

- Turnover in the border zone also tends to be much higher than that found in other regions due to the intense competition and a more transient labor force.

- Security can be an issue. Border cities tend to have some of the worst security situations and highest levels of crime of any Mexican city.

2. Northeast Mexico

Northeastern Mexico’s industrialized regions are found largely within the states of Coahuila, Nuevo Leon, and Chihuahua. The areas around Monterrey and Saltillo have been industrialized for more than a century. Other options include Chihuahua, Torreon, and Monclova.

Benefits:

- There's excellent manpower and services available in this region. Moreover, skilled labor is available at a lower cost and comes with significantly less turnover than in the border zone.

- The U.S. still remains within an easy drive of Northeast Mexico’s factories.

- Due to its dense industrialization, the region is home to clusters of customers across several sectors.

- The Northeast is typically much safer than the border zone, with lower levels of violent crime and greater personal safety.

Drawbacks:

- Northeast Mexico makes it difficult for some manufacturers to service the Mexican market, the bulk of which is closer to Mexico City.

- While more cost-effective than the border zone, costs here are still higher than in some other areas of Mexico.

3. Northwest Mexico

This primarily includes the state of Sonora and the city of Hermosillo, and the coastal cities of Empalme and Guaymas.

Benefits:

- The location is still relatively close to the United States, with proximity to the Arizona border and west coast U.S. cities, as well as Pacific Ocean port access.

- Because the area has not been industrialized for very long, manufacturing costs don't tend to be as high as in more northern cities.

- There's lower turnover in this region than in the border zone, more comparable to the levels seen in Monterrey or Saltillo.

Drawbacks:

- The area has a lower level of industrialization than some other cities. Combined with a smaller population, some companies find there to be fewer skills and services available.

- There are fewer opportunities to connect with local customers.

- The market still remains far from the Mexican market, the bulk of which is closer to Mexico City.

4. Bajio Region

This central area, immediately north of Mexico City, includes the states of Aguascalientes, Guanajuato, San Luis Potosi, and Queretaro. There are a wide range of cities here, large and small, providing manufacturers with options.

Benefits:

- This region offers excellent distribution to the Mexican market in terms of the geographic center of the population in Mexico as well as the ability to reach manufacturers located in Mexico. There is also easy access to major ports on both coasts.

- Costs in this region are similar to the Northeast.

- It’s a good market for both skilled labor and services to support operations. Turnover, in general is fairly low.

- This growing area is home to sizable clusters in several industries, including automotive, aerospace, electronics, appliances, apparel, and food production.

Drawbacks:

- If the bulk of your goods are being shipped north into the United States or Canada, then this location can seem fairly far away. For example, Queretaro is about 12 hours south of the border by truck.

- This more recently industrialized region is still working to build infrastructure on pace with the region’s growth. While manufacturing support infrastructure is fairly robust, roads, highways, rail lines, power lines, and other infrastructure is still growing, which can cause some congestion in some areas.

5. Southeast Mexico

This area below Mexico City encompasses the states of Puebla and the State of Mexico.

Benefits:

- There is a strong automotive customer base here. Volkswagen has most of it's manufacturing in the state of Puebla, while Chrysler is in Toluca, Estado de Mexico.

- There is a long history of industrialization in this area, with established infrastructure, services, and skilled manpower.

- Costs are highly competitive with other regions.

- Manufacturers gain excellent access to Mexico City without the congestion and cost of being in Mexico City and access to the Mexican market.

Drawbacks:

- This location is even further from the U.S. market, with Puebla at about a 14-hour drive to Laredo, Texas. It’s also further from most Mexican industrial customers, at the southern boundary of the country’s industrial base.

- Security can be poor in some cities, although this varies by location.

- Turnover and cost can be high in some areas, requiring companies to do their due diligence as they evaluate specific cities.

6. Guadalajara

The second largest metropolitan area in Mexico, Guadalajara in the state of Jalisco, has earned a reputation as the Silicon Valley of Mexico. It is also the main hub for Mexican distribution. The electronics, computing, and distribution hubs that exist in Guadalajara make it a unique location.

Benefits:

- Guadalajara offers excellent west coast port access and reasonably good access to the east coast.

- The environment around Guadalajara is ideal for ex-pats, with a large ex-pat community at Lake Chapala and excellent ex-pat services.

- Unskilled wages tend to be highly competitive.

Drawbacks:

- Professional wages are higher, as is demand for certain skills, particularly engineering professionals or software engineers.

- Real estate can be expensive and difficult to come by, particularly for greenfield construction.

- There is a significant distance to customers in the Northeast or Northwest of Mexico, as well as the U.S. market.

- In general, security is not as good as in some other cities. While there are regions within Guadalajara that are very safe, like any large city, there are areas that can be unsafe.

It’s time to make a decision

Once you've developed a short list of potential sites, it's time to reach out to advisors who can provide better insight into these markets and locations. Customers and suppliers with operations in Mexico can provide useful insight. However, when you’re truly ready to dive into site analysis, there’s no better partner than Tetakawi.

Not ready to make the move yet? Then we invite you to listen to our podcast on site selection and other Manufacturing in Mexico podcasts.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.