THE GLOBAL ELECTRONICS MANUFACTURING INDUSTRY

The outsourced electronics manufacturing industry is a global industry comprising thousands of companies. This includes traditional electronic contract manufacturers (CMs) or electronic manufacturing services (EMS) companies that build products on behalf of their OEM clients based on the OEM’s design; and original design manufacturers (ODMs) that build products for OEMs leveraging their own product designs. In between these two traditional models has emerged another option variously referred to as joint design manufacturing (JDM), or contract design manufacturing (CDM). In this model the OEM and its outsourcing partner collaborate to various degrees to develop and manufacture product(s). The exact size of the industry and its future growth potential varies depending on the research group to which you subscribe. In order to provide a balanced view of the industry, we present the sizing and forecasts of three leading industry research groups, each of which has been studying the industry for many years. The data included here was drawn only from publicly available data or used with permission of the firm. The research companies are:

International Data Corp (IDC) (www.idc.com)

New Venture Research (NVR) (www.newventureresearch.com)

We use data compiled in January 2011, but several of these research firms offer updates to their forecasts during the year as new data and trends warrant so we cannot guarantee that they are the most current.

Table 3.1 below reflects the actual data figures offered by each of the research firms for the electronics manufacturing industry (comprising both EMS and ODM). It is important to note that the revenue figures for 2009 are actual revenue numbers, while those for 2010 are only estimates, and those for 2011 – 2014 are forecasts. The differences in the figures generated by the three firms are attributable to differences in methodologies and the companies included in their individual assessments.

Figure 3.1

Historically, EMS has been the larger percentage of these combined revenues, but ODM has reached a point of parity in recent years and is generally expected to be the larger percentage in the years ahead. This means that in 2009 EMS was roughly a US$120B industry.It is worth noting that the largest revenue generating service for the EMS industry is printed circuit board assembly (PCBA). ODMs in contrast sell primarily completed assemblies or products. There is no available sizing data of the EMS industry in specific countries as none of these research firms provides such analysis anymore, nor was CBA able to identify any such data that was more than anecdotal.

3.2 THE EMS MARKET IN CHINA AND MEXICO

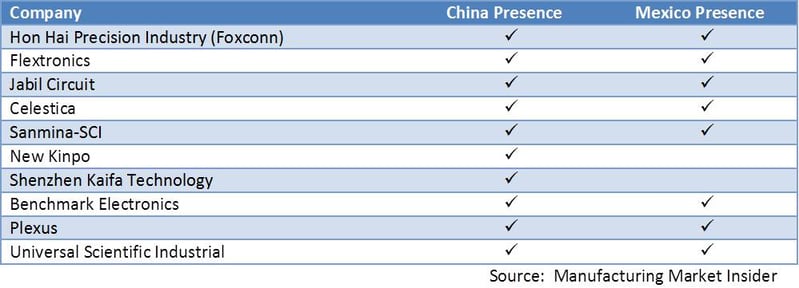

The composition of the EMS markets in China and Mexico are quite different. While the Chinese market is comprised of both indigenous and global companies, Mexico is comprised almost exclusively of non-Mexican service providers primarily from the United States.Table 3.2.1 reflects the top ten EMS from 2010 and whether they have a facility in China and/or Mexico. This top ten EMS list is derived from the annual Top 50 EMS Providers list produced by Manufacturing Market Insider (www.mfgmkt.com) each March.

Table 3.2.1

Top Tier EMS Footprint

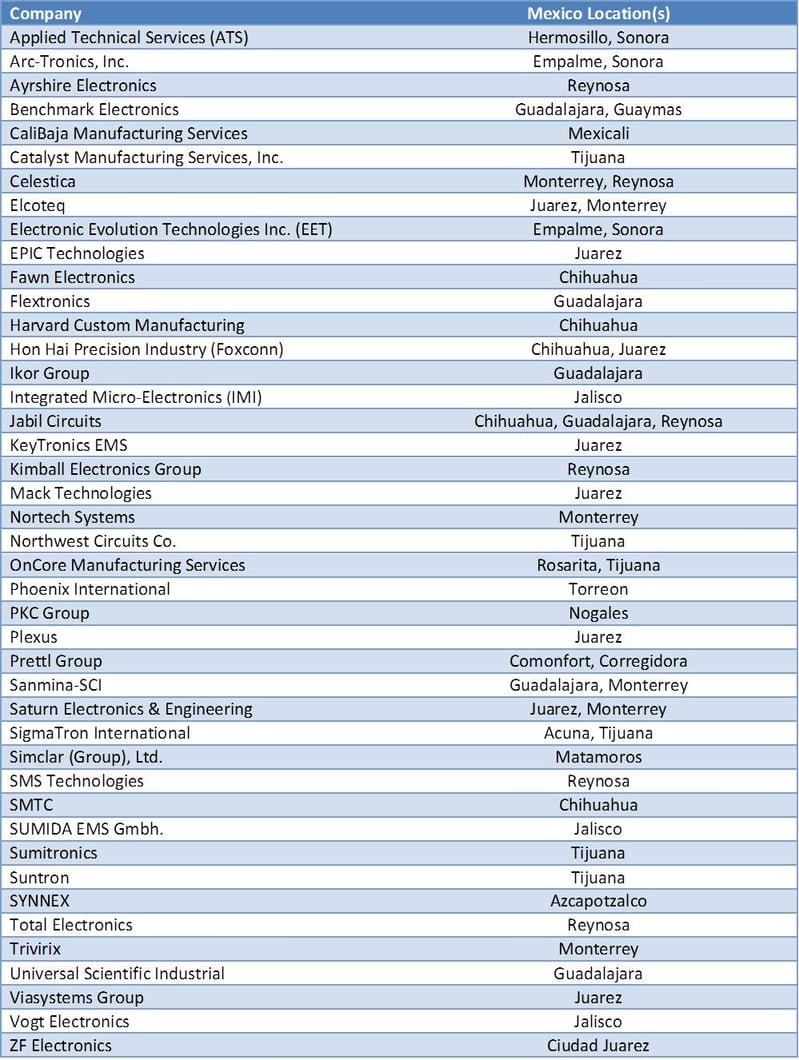

The number of EMS companies, both indigenous and foreign owned, operating in China is so vast as to be nearly impossible to list. The list of EMS in Mexico in comparison is fairly short and is included in Table 3.2.2. This is not an all inclusive list, but does reflect what CBA believes to be the vast majority of EMS companies currently operating a facility in Mexico.

Table 3.2.2

List of EMS with Operations in Mexico

"China v. Mexico: An Objective Comparison for Midmarket Electronics OEMs." by Charlie Barnhart & Associates.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.