An overview of Mexico and China country may be useful to companies considering engaging electronics manufacturing services either of the countries. We used information from a Charlie Barnhart & Associates report that addresses issues at the intersection of electronics OEMs and outsourced manufacturing providers in China and Mexico.

Country Profiles

China and Mexico are vastly different countries.

Table 1 presents a comparative profile of both countries in various data categories. The United States is also included for comparison.

Table 1

Country Comparisons

| Category | China | Mexico | USA |

| Population (July 2011 Estimate) | 1,336,718,015 | 113,724,226 | 313,232,044 |

| Population (world ranking) | 1st | 11th | 3rd |

| Land mass (world ranking) | 4th | 14th | 3rd |

|

Geopolitical Stability: |

|||

| Government type | Communist State | Federal Republic | Constitution-based federal republic |

| Legal system | Civil law influenced by Soviet and continental European civil law systems; legislature retains power to interpret statutes; constitution ambiguous on judicial review of legislation | Civil law system with US constitutional law theory influence; judicial review of legislative acts | Common law system based on English common law at the federal level; state legal systems based on common law except Louisiana, which is based on Napoleonic civil code; judicial review of legislative acts |

|

ECONOMIC INDICATORS: |

|||

| GDP in 2010 Estimate (US$) | $10.09T | $1.567T | $14.66T |

| GDP in 2010 (world ranking) | 3rd | 12th | 2nd |

| GDP Real Growth Rate (2010 Est) | 10.30% | 5.50% | 2.80% |

| GDP/capita 2010 (US$) | 7,600 | 13,900 | 47,200 |

| GDP/capita 2010 (world ranking) | 126th | 85th | 11th |

| Inflation Rate (2010) (consumer prices) | 5% | 4.10% | 1.40% |

| Top 3 Export Partners (2009) | USA, Hong Kong, Japan | USA | Canada, Mexico, China |

| Top 3 Import Partners (2009) | Japan, South Korea, USA | USA, China, Japan | China, Canada, Mexico |

| Category | China | Mexico | USA |

| Reserves of Foreign Exchange & Gold (2010) | $2.622T | $116.4B | n/a |

| Debt - External (2010) | $406.6B | $212.5B | $13.98T |

|

WORKFORCE: |

|||

| Literacy Rate | 92.20% | 86.10% | 99.00% |

| School Life expectancy | 12 years | 14 years | 16 years |

| Labor Force in 2010 Est. | 780M | 46.99M | 154.9M |

| Labor Force in 2010 (world ranking) | 1st | 12th | 4th |

| Unemployment rate in 2010 | 4.30% | 5.60% | 9.70% |

| Unemployment rate in 2010 (world ranking) | 41st | 55th | 106th |

| Urban population rate (2010) | 47% | 78% | 82% |

|

INFRASTRUCTURE: |

|||

| Electricity Production in 2008 (world ranking) | 2nd | 15th | 1st |

| Electricity Consumption in 2009 (world ranking) | 2nd | 20th | 1st |

| # Airports with paved runways | 442 | 250 | 5,194 |

| Kms of Railway (world ranking) | 3rd | 16th | 1st |

| Kms of Roadway (world ranking) | 2nd | 17th | 1st |

| # Maritime Ports & Terminals | 8 | 6 | 10 |

|

Market for Electronics: |

|||

| # Cell phone users (2009) | 747M | 83.528M | 286M |

| # Cell phone users (world ranking) | 1st | 13th | 3rd |

| # Internet users (2009) | 389M | 31.02M | 245M |

| # Internet users (world ranking) | 1st | 12th | 2nd |

|

Ease of Doing Business & CORRUPTION PERCEPTION INDEX: |

|||

| 2010 Ease of Doing Business (world ranking) | 89th | 51st | 4th |

| 2010 Corruption Perception Index (10 = highly clean, 0 = highly corrupt) | 3.5 | 3.1 | 7.1 |

Sources: CIA World Factbook; Transparency International; World Bank and International Finance Corporation Doing Business database

Manufacturing Regions

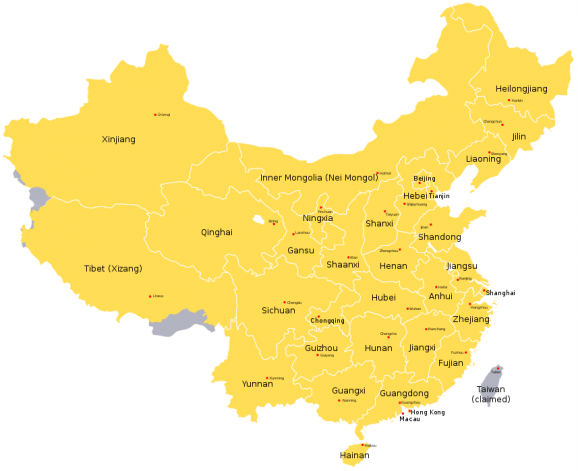

Electronics manufacturing in both China and Mexico tends to be clustered in distinct regions of each country. In China these regions include primarily Guangdong province in Southern China (i.e., The Pearl River Delta) and the Shanghai area on the eastern coast of China, and there is now a drive to establish manufacturing in western/central China especially in Chongqing and Sichuan provinces. In Mexico the main regions are the border zone along the United States where most of the maquiladoras operate, and then in and around the cities of Guadalajara and Monterrey in the interior of the country.

Figure 2.

Map of Primary Electronics Manufacturing Regions in China

- Sichuan Province

Chonquing - Guangdong Province

- Anhui Province

Shanghai

Source: http://en.wikipedia.org/wiki/Province_(China)

Figure 3

Map of Primary Electronics Manufacturing Regions in Mexico

- The border region

- Southern Sonora

- Monterrey

- Guadalajara

Source: http://www.ezilon.com/maps/images/northamerica/political-map-of-Mexico.gif

Main Industries Served

The EMS industry is notorious for members claiming they can build anything anywhere. While this may be theoretically true, the reality, as will be reflected in the data contained in Chapter 4, is that OEMs see both China and Mexico as offering competent electronic manufacturing in only certain service categories.

It is possible however to generalize the types of electronics products best suited for each country. This does not mean just printed circuit board assembly (PCBA), which can be competently performed all over the world, but actual complete box build.

In general, China is best suited for commoditized products with mature product designs. These tend to be primarily products in the industry sectors referred to as the “3Cs” (communications, computer, and

consumer). In contrast, Mexico is generally best suited for larger, heavier products destined for export to the United States. These products are primarily in the industry sectors CBA refers to as the “3As” (aerospace, automotive, and appliances).

Both countries also build products in other industry sectors such as industrial, medical, instrumentation, as well as the sectors referenced for each country. The important point for North American based midmarket OEMs to remember is that your product profile, both in terms of its size and configuration as well as the end market into which it will be sold, must be considered when selecting either China or Mexico for your manufacturing needs.

Military electronics for the United States cannot be performed in either country since this type of work is typically restricted to ITAR certified companies.

Business Models for Manufacturing

OEMs seeking to establish manufacturing operations in China or Mexico have several options available. In both China and Mexico an OEM can choose one of these three options:

- Wholly owned subsidiary: the OEM establishes its own manufacturing entity in the country.

- Joint venture: the OEM partners with an indigenous partner to set up a manufacturing operation in the country.

- Outsource to EMS/ODM: the OEM outsources some or all manufacturing processes to an EMS or ODM company operating in the country.

In Mexico there is the additional option of utilizing a Mexico manufacturing shelter. This option, as described by our report sponsor The Offshore Group allows OEMs:

“… to control production, product quality, and allows executives to benefit from the experience of an organization that understands the local market and eliminates the need to make sizeable investments in physical and human assets.

Working through shelter service providers, a foreign-based manufacturer is able to initiate operations quickly without the need to establish a legal presence in Mexico.

In such instances, companies operate in the country as a ‘department’ of their chosen service provider. Firms are ‘sheltered’ from some risks and liabilities that normally affect organizations alternatively choosing to incorporate in Mexico.

Under typical shelter arrangements, manufacturers send raw materials and supervisory personnel to train and manage a Mexican workforce while a shelter company performs the tasks and functions not core to the manufacturing process.”[1]

The decision on which option is best suited for an OEM is influenced by many factors and is a discussion outside the intended scope of this report. It should be noted, however, that these options are not mutually exclusive and a combination of several might in some cases be the best option for a midmarket OEM.

What Lies Beyond Outsourcing?

Business models change and evolve. CBA will be releasing a report in 2012 that addresses this question. The following is a brief summary of the rationale for that report.

In the early days of the EMS industry outsourcing was used primarily as a tool for off-setting peak requirements so OEMs could maintain a Level Production Schedule (LPS) which was then, and still is today, the most efficient way to run any manufacturing operation. This approach allowed OEMs to avoid absorbing additional fixed costs (for people, plant, property and equipment) by converting them to a variable basis while not compromising product quality or core-competency.

This approach also provided a significant uplift in an OEM’s return on assets employed (ROAE), a financial metric that was at that time being evangelized by the then up-and-coming crop of business academics and managers from the post WWII generation. This group of theorists arguably subscribed to a business ethos that was so deeply rooted in exploitation of the global market dynamic that it tended to marginalize the value of the technical, operational and administrative functions of the enterprise and ultimately brought about the demise of the vertically integrated business model within Western industry.

Concurrently in the electronic industry the interconnect solution was switching from a bulky, crude, highly-limiting pin-through-hole (PTH) assembly approach to surface mount technology (SMT) as

electronic components became more integrated, much smaller in physical size and far lighter in weight. Smaller, faster and lighter with dazzling new levels of capabilities became the new mantra of virtually all product sectors and the electronics revolution – virtually – changed the world.

This ‘sea change’ in electronics technology required the implementation of entirely new manufacturing approaches, tools and equipment and while some OEMs were prepared to make the necessary and substantial investment in equipment, tools and training to support this technological revolution most were not. And outsourcing – within one decade – transformed itself from a handful of mostly garage-shop based local operations to an industrial powerhouse valued in the 100s of billions of USD annually with 1,000s of facilities worldwide.

Unfortunately, as often happens when times are too good to be sustainable, the inevitable downturn occurred to correct the imbalance and the thin veneer of an over-leveraged solution (outsourcing) began to reveal more flaws than it could possibly hide.

Bottom-line, outsourcing (in any of its many forms) as a business “strategy” is a onetime dividend that is unsustainable, but as a tool can produce profound results. Like dynamite, apply it skillfully and significant work can be achieved at impressive speed, but ignore its inherent danger and it will kill you. Does this sound like the solution for the masses?

Perhaps it’s time to explore what alternatives live Beyond Outsourcing, not because dynamite isn’t an expedient way to remove the tree-stump, it’s just not always the safest solution when the stump is located in your front yard. Besides, ROAE was long ago trumped by EPS on Wall Street!

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.