Manufacturing in Mexico is a popular option for foreign direct investors for many reasons. Mexico provides manufacturing companies with a significant competitive advantage in logistics. Its location ensures competitive speed to market as manufacturers can rapidly deliver products to the world’s largest consumer market, the United States. It’s a low-cost manufacturing location with the added advantage of stable demographics and a skilled workforce. Its business-friendly environment incentivizes foreign investment. The only question that remains then is how to get started.

In this article, we will provide information that can help you identify the right approach for a launch into Mexico. This includes:

- A list of industries with the biggest manufacturing presence in Mexico.

- Regions with the most robust manufacturing presence.

- Factors to consider in the site selection process.

- Expectations for typical manufacturing costs.

- The most popular operational models for launch.

- Partners that can help strengthen your operations.

With this insight, organizations can better determine the right approach for their launch.

Who is manufacturing in Mexico?

Manufacturing in Mexico can provide virtually any company with a competitive advantage through logistics and low costs. However, a handful of sectors will find advantages from concentrated supply chains. Five industries, in particular, have dense supply chains in Mexico. These include:

- Automotive. Mexico has been a powerhouse in automotive manufacturing for more than a century. This includes the production of passenger vehicles, trucks, automotive components, and supplies. Ten automotive OEMs have established a presence in Mexico. They work with tiered supplier networks to enhance productivity and export functions. Automotive manufacturing companies have a presence in every corner of the country. Popular automotive clusters in Mexico include Coahuila, San Luis Potosí, Baja California, Sonora, Nuevo León, Queretaro, Jalisco, and Guanajuato.

- Aerospace. Aerospace manufacturing makes up almost half of the foreign direct investment in Mexico. More than 350 aerospace manufacturers supply parts ranging from engines and turbines to electrical assemblies and technology solutions. These companies operate out of industrial clusters concentrated in Queretaro, Sonora, Chihuahua, Nuevo Leon, and Baja California.

- Medical devices. The complex assembly behind medical device manufacturing demands skilled labor. It’s a trait for which Mexico’s workforce is well known. In 2020, the country exported more than USD $10 billion in medical instruments, making it the third largest such exporter in the world. Companies gain a competitive advantage in logistics through clusters in Baja California, followed by Chihuahua, Coahuila, Nuevo León, Jalisco, Sonora, and Tamaulipas.

- Electronics. Electronics manufacturing in Mexico supports many other manufacturing activities in the country. Western Mexico specializes in aerospace, hi-tech, IT, and electronic sub-assembly parts. This technology is found in the states of Baja California, Sonora, Chihuahua, Jalisco, and Aguascalientes. Eastern Mexico specializes in manufacturing parts for computers, home appliances, and consumer goods. This activity is concentrated in Coahuila, Mexico City, Nuevo León, Querétaro, and Tamaulipas. Both regions specialize in automotive and telecommunications components.

- Appliances. Mexico is a major exporter of appliances. Some of the world’s largest brands are located in Mexico. Many of the companies pull from suppliers and laborers well-versed in electronics and other similar sectors. Clusters include Queretaro, Tecate, Guadalajara, Monterrey, and Saltillo.

What are the most popular manufacturing venues in Mexico?

Variations in demographics, infrastructure availability, and low-cost manufacturing abound across Mexico. As a result, it’s important to establish clear priorities before selecting a site. In general, however, the most popular manufacturing locations and venues in Mexico include the following:

- Tijuana attracts many manufacturers through its competitive advantage in logistics due to its proximity to the U.S. border. The city also has one of the country’s largest populations, with 26% of the economically active population working in the manufacturing sector. This easy U.S. access comes at the cost of potentially steeper costs for wages and facilities. Tijuana is amongst the most expensive places to operate in Mexico.

- Monterrey is a commercial, industrial, educational, and transportation hub of northern Mexico. As a center for steel production, the city has proven attractive to a wide range of manufacturing sectors. In recent years, Monterrey has become the destination location for Chinese-owned manufacturing companies looking to tap into Mexico's manufacturing advantages.

- Saltillo, the industrial capital of Coahuila, is an automotive manufacturing powerhouse. Chrysler and General Motors established bases here in the 1950s. Today, many training institutes and research centers support this sector. The benefit of Saltillo is that it is about an hour away from Monterrey but has a lower cost structure and a more stable workforce.

- Queretaro has a strong aerospace presence. It is home to manufacturers that include Airbus, Bombardier, and Safran. Due to its distance from the U.S border, wages for the local workforce tend to be more competitive than in other areas.

- Hermosillo, Guaymas, and Empalme in Sonora create a network of manufacturing cities covering many sectors. Manufacturers can find a stable labor force at competitive wages. This area also offers access to a deep-water port, an international airport, and major U.S. highways.

Site selection factors to consider in Mexico

Each region in Mexico offers distinct advantages, so have your priorities in order as you consider potential sites. Factors to consider in your search include:

- Transportation ease. Is immediate access to the U.S. or other markets a priority? It is for the more than 56% of maquiladoras in Mexico that opt for a site in one of the six Mexican states bordering the United States. Consider potential sites’ proximity to major highways, land ports of entry, airports, seaports, and rail spurs.

- Labor costs. Are you willing to locate further south where manufacturing wages may be less competitive? If so, are you certain that staffing will be available? Consider, too, that operating in rural areas may lead to extra costs for employee transportation or food services.

- Industrial clusters. Are there certain supplier types whose proximity you’d like to leverage? Regions where manufacturing centers around specific industries often develop shared infrastructure. Examples include the Aeronautical University in Queretaro and the Center for Innovation and Automotive Development at Queretaro Polytechnic University.

- Real estate needs. Do you need space to build a greenfield facility? Or Class A build-to-suit manufacturing space? In either case, manufacturers should ensure the availability of utilities. Sites already connected to infrastructure to prevent the risk of service disruptions.

Manufacturing communities help many companies address these needs. These facilities combine leasable Class A industrial space with a range of support services. Communities like Bella Vista in Sonora or the Zapa Manufacturing Community in Saltillo ensure utility connectivity, provide onsite training, and feature amenities to attract employees.

Listen to this podcast for more site selection tips for manufacturing in Mexico:

Plan a complete cost analysis

Labor cost savings are a leading driver for companies to manufacture in Mexico. But labor costs are only one small part of the picture. To ensure your company sees cost savings, conduct a cost analysis of initial and long-term costs. This analysis can also help drive site decisions.

Some factors to include in a cost analysis are:

- Lease rates. Average lease rates per square foot per month, triple net, can range from USD 0.54 to $0.75 in Mexico. Prices will fluctuate depending on the region, the quality of the industrial property, and market demand.

- Utility costs: Electrical costs, on average, fall around $0.110 per kWh. In some areas, these costs may be offset by different air conditioning or humidity control demands. Natural gas costs will range from USD 0.037 per m3 to $0.0956 per m3, depending on the region and monthly volume. Water and sewer costs of USD 0.007 per gallon are typical.

- Payroll. Wages will vary depending on the skill set required. On average, unskilled direct laborers in Mexico may earn around USD $4.55 per hour. More skilled direct laborers, such as CNC machinists who may have several years of training, may make closer to USD $8.10 per hour. For indirect labor positions, such as a materials planner, wages might average closer to USD $13.51 per hour for a specific skill set.

- Logistics. In addition to typical freight costs, companies will need to factor in customs costs. These costs will vary based on where you’re shipping your products and how often you ship.

- Regulatory and administrative costs. There will be initial fees for incorporation, registration requirements, and operating permits. A shelter service provider can help reduce some of these costs.

- Comparable costs. An accurate cost analysis should benchmark operational costs in similar industries and regions. This will provide a sense of whether you’re getting the most out of your operational expenditures.

Find the right model for entry into Mexico

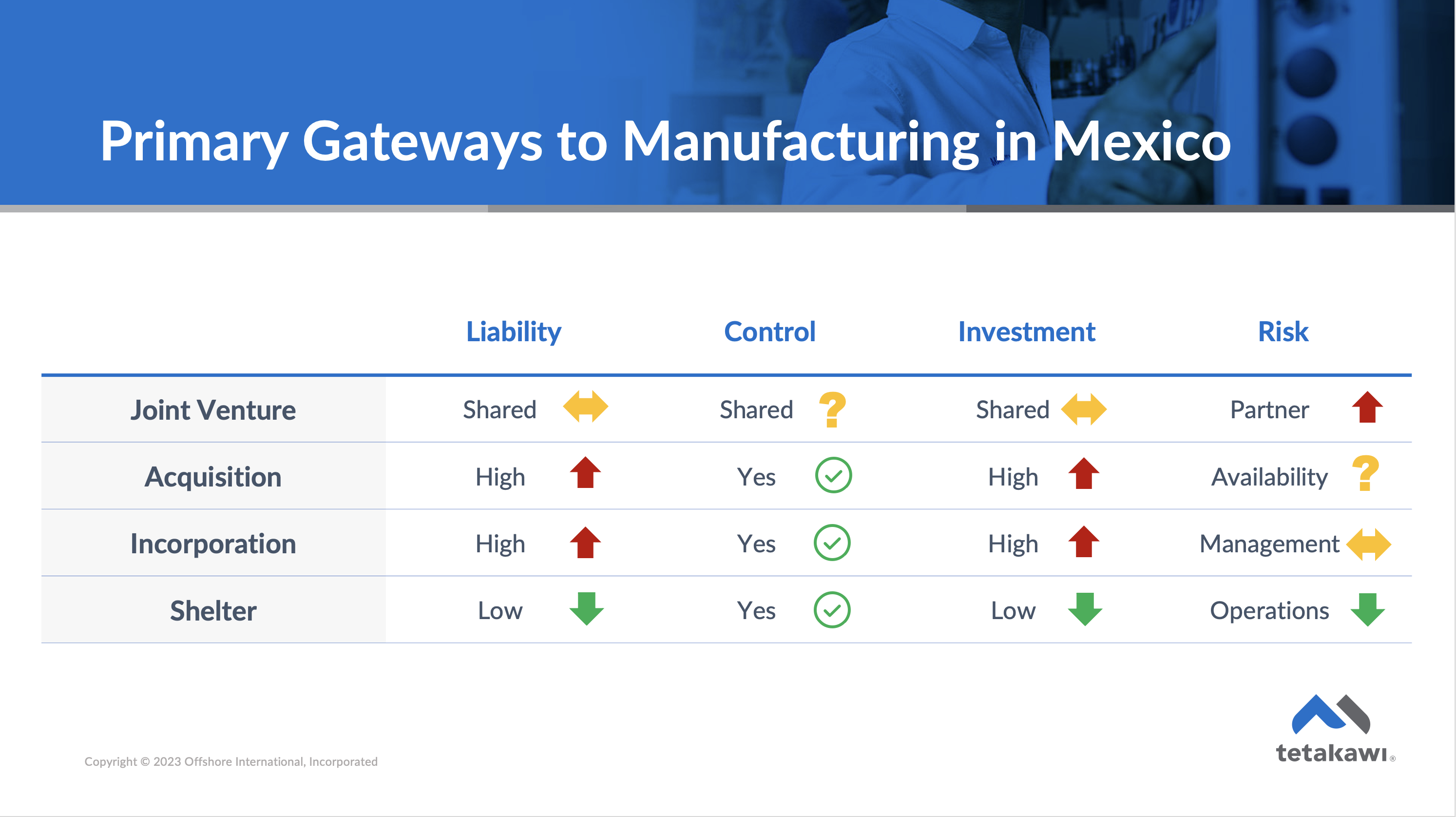

Once you’ve selected a location, it’s time to identify the right operational model for your organization. In Mexico, there are several options available. Each offers companies varying levels of control and responsibility.

Standalone model

A foreign company can opt to form a new legal entity in Mexico. As they would at home, the standalone company holds responsibility for securing permits, managing regulatory requirements, and paying full income and consumption taxes. This model gives a company complete control over its Mexico operations. However, many companies opt to outsource certain functions to local consultants.

Foreign investors that will export all goods manufactured in Mexico do not need to establish a separate legal entity in Mexico. However, if the manufacturer plans to invoice the sale of those goods and services to companies within Mexico, it must have a Mexican entity.

Shelter model

The term “shelter” implies shielding the international company from exposure to trade, labor, and tax laws. Under this unique operating model, an IMMEX-registered shelter service provider serves as the legal entity responsible for regulatory compliance. Foreign investors have control of all production-related functions and assets. The shelter company handles all administrative and non-production burdens.

Shelter service providers do not all offer the same level of service. As a result, it’s essential to identify the level of support that is right for your organization. There are roughly six levels of services available from shelter companies in Mexico:

- Full-service Mexico shelter companies provide a complete array of services. This includes help from start-ups and real estate leasing to ongoing accounting and HR support. With full-service support, companies can begin manufacturing in Mexico in as little as 30 days.

- Full shelter services focus on administrative support from day one. However, these companies aren’t in the business of leasing real estate.

- Mexico shelter companies for start-ups help foreign manufacturing entities get set up. After launch, they turn daily operations over to the international manufacturer’s in-house support team.

- Contract manufacturing plus shelter services connect manufacturers with support on an as-needed basis. This support includes subcontracted workers.

- Real estate companies that also offer shelter services focus on the rental and sale of industrial real estate. Some may also provide some level of administrative support.

- Pick-and-choose shelter services allow manufacturers to tailor service offerings that meet specific needs.

Contract manufacturing model

Contract manufacturing in Mexico is like models used in other countries. Through this model, a foreign company pays a contract manufacturer in Mexico to produce goods. This model requires no investment in production assets. However, the foreign company has limited control over the quality of the contractor’s work.

Merger or acquisition model

Some foreign investors opt to acquire or merge with an established Mexican manufacturer. The international company gains production assets and operations already achieving regulatory compliance. A merger or acquisition can shorten the process of launching operations. However, there are risks to integrating management partners who may hold different expectations.

Joint venture model

A joint venture is a partnership between two companies. Each company contributes their unique strengths toward achieving a common goal. Often the foreign company provides a customer base and the Mexican manufacturer provides assets and expertise to meet the demand for specific product types.

Listen to this podcast to learn more about modes of entry for manufacturing in Mexico:

Partners to support manufacturing success in Mexico

Once you know where and how to launch operations in Mexico, it’s time to build the partnerships that will ensure your success. For many companies, this will mean connecting with shelter service providers and local suppliers. However, there are a few other organizations and partners to reach out to:

- Local government. Manufacturing is a major economic driver in Mexico, contributing more than $10 billion to the country’s GDP in 2021. As a result, incentives may be available to encourage investment at a specific site. Shelter service providers may have insight into local incentives. Or, consider reaching out to trade organizations or economic development groups in the state.

- Regulatory authorities. Companies operating under a shelter service provider can reduce a regulatory burden that includes IMMEX registration. Others will need to obtain registration permits from the Social Security Department (IMSS), Customs (ADUANAS), and the Department of Environmental Health and Safety (SEMARNAT), among others.

- Recruiting services. Hiring strategies and retention best practices have unique nuances in Mexico. Maximize your chance for successful recruitment with an expert well-versed in local expectations and norms.

- Authorized customs brokers. Only approved Mexican customs brokers can clear your manufactured goods through Mexican customs. Reach out to these partners early to put appropriate processes in place.

- Local suppliers. There may be opportunities to streamline costs by getting to know local suppliers’ parts capacity and competency in providing quality parts.

- Training centers. Skill development is a priority in Mexico, and a requirement for larger organizations. Rather than reinventing the wheel here, manufacturing companies may be able to partner with local technical schools or training centers for employee training.

Ready to manufacture in Mexico?

Operating in a low-cost manufacturing environment is a fine strategy for reducing operational expenses. However, truly seeing those cost benefits demands ample advance planning. Speed to market also plays a major role in realizing cost savings. Companies that ramp up their manufacturing operations fast will see a faster return on their investment. This is one more area where manufacturing in Mexico offers significant advantages. Working with an experienced advisor can be a major source of strength for foreign manufacturers.

To develop the right approach for your company to begin manufacturing in Mexico today, contact Tetakawi.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

.jpg)