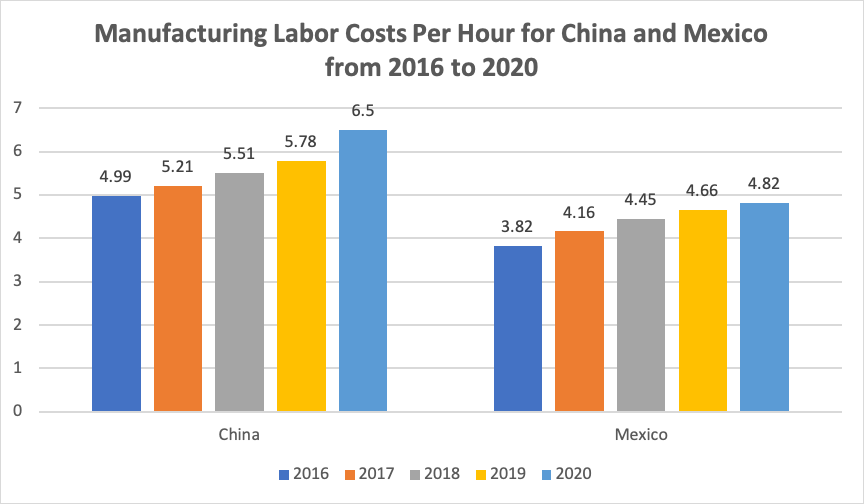

Amidst the evolving landscape of global manufacturing, offshore manufacturing in Mexico emerges as a compelling solution for companies seeking competitive cost savings without compromising on quality. As wage differentials between traditional manufacturing hubs like China and Mexico continue to shift, Mexico's allure as an offshore destination grows stronger.

With a detailed comparative wage analysis revealing Mexico's favorable position, particularly in regions boasting manufacturing clusters like Tijuana, Monterrey, and Querétaro, it's evident that Mexico offers a strategic advantage for companies seeking to optimize their manufacturing footprint. Moreover, Mexico's reputation for quality manufacturing, supported by its skilled workforce and robust educational infrastructure, solidifies its position as a top choice for offshore operations.

Leveraging tools such as Tetakawi's online payroll cost calculator and expert consultation services tailored for offshore manufacturing in Mexico ensures that companies can navigate the complexities of offshoring with confidence and efficiency.

Source: Statista

A closer look at specific wages in Mexico vs China

This at-a-glance average wage can’t account for the local and job-specific discrepancies impacting the 112 million manufacturing workers across all of China. Still, it does provide some insight into China’s maturing labor force. Low-cost manufacturing is still available, typically moving to more inland locations. However, the maturing Chinese manufacturing industry is also serving more demand from its own national market.

Like China, Mexico has an established manufacturing industry, but wages here have remained reasonably competitive for the high-quality work performed. Tetakawi provides a closer breakdown of the average manufacturing salaries across Mexico based on specific skillsets.

Those rates, of course, vary across specific regions, depending on local conditions and distance to more concentrated markets.

|

Average Fully Fringed Annual Salaries for Manufacturing Workers in Mexico |

|

|

Category |

USD Per Year for Dayshift |

|

Unskilled direct labor |

$7,220 |

|

Semi-skilled direct |

$10,594 |

|

Skilled direct |

$12,255 |

|

Unskilled Indirect |

$9,858 |

|

Semi-skilled Indirect |

$11,084 |

Wage projections: Mexico vs. China

Looking back at historical wage growth offers an indication of what’s ahead. While Mexico’s president has instituted two minimum wage hikes, at the start of 2019 and 2020 respectively, those have had little impact on the comparatively higher-earning manufacturing industries.

“[T]he 2020 minimum wage will likely not be high enough to reduce formal employment in a significant way,” commented David Kaplan, Senior Labor Markets Specialist at the Inter-American Development Bank.

China, however, has consistently seen increases of more than 7% in manufacturing wages each year for about the last decade.

|

Average Annual Manufacturing Salary in China (Based on 6.83 CNY per USD Exchange Rate) |

||

|

Year |

Average Annual Manufacturing Salary |

Percent Increase Over Previous Year |

|

2014 |

$7,517 |

|

|

2015 |

$8,096 |

7.7% |

|

2016 |

$8,703 |

7.4% |

|

2017 |

$9,432 |

8.3% |

|

2018 |

$10,548 |

11.8% |

|

2019 |

$11,435 |

8.4% |

|

2021* |

$12,306 |

7.6% |

|

2022* |

$13,257 |

7.7% |

Source: Statista. * Projected data.

Balancing low cost with high quality

There are, of course, other low-cost offshoring locations for manufacturers to consider. The key to factor in here, however, is the relative maturity of the surrounding product delivery ecosystem. Like China, Mexico has made a name for itself in delivering incredibly complex products for sophisticated customers in the aerospace, automotive, and medical device manufacturing industries. The level of quality expected from names such as Boeing, Medtronic, BMW, all of which manufacture within Mexico, hints at the expectation for quality labor one can find here.

Experience plays a significant role in this quality. Over the decades, the Mexican government and local corporations have made significant strides in investing in educational infrastructure to support the skillsets necessary to support complex manufacturing. Foreign direct investors coming to manufacture in Mexico today will find a highly skilled workforce. Centers like the Advanced Technology Training Center (CEFTA) in the Roca Fuerte Manufacturing Community in Sonora provide manufacturers with a platform for training the local workforce on specialized manufacturing skills.

Customize your cost analysis

If competitive costing is a significant driver of your decision to offshore, then it’s essential to get a detailed picture of your overall cost savings. Those savings will vary across countries, and within those targeted countries, and will vary based on the costs of getting your operation up and running.

To begin developing a more complete picture of what it costs to manufacture in Mexico, Tetakawi has developed an online payroll cost calculator. Consider this the next step in ascertaining the costs of moving manufacturing to Mexico.

To get the most comprehensive understanding of your potential costs, contact Tetakawi for a cost estimation today.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.