Manufacturing in Mexico is an excellent strategy for companies across a range of manufacturing industries that are looking to strengthen operational resiliency while lowering production costs. Manufacturing companies that once focused on countries such as China or Southeast Asia are now finding Mexico a more cost-effective option due to its easy proximity to the massive U.S. market. It is also becoming easier than ever to build a local supplier network and find real estate with critical supporting infrastructure as manufacturing booms across key industrial clusters. As a result, in 2019, Mexico was the 9th largest exporter in the world and poised for growth.

One of the key advantages of manufacturing in Mexico is the unparalleled market access it provides to companies, particularly those looking to target the lucrative North American market. With its strategic location bordering the United States, Mexico offers unparalleled access to one of the largest consumer markets in the world.

This proximity not only reduces shipping times and transportation costs but also facilitates seamless supply chain management, enabling companies to respond quickly to changing consumer demands. Moreover, Mexico's extensive network of free trade agreements, including the USMCA, grants companies preferential access to markets across North America, Latin America, and beyond. By establishing manufacturing operations in Mexico, companies can leverage these agreements to expand their market reach, increase competitiveness, and capitalize on new growth opportunities.

Major Industries Manufacturing in Mexico

While a range of world-renowned industries are finding success in launching in or moving their manufacturing to Mexico, the most robust industries in Mexico currently are the automotive, aerospace, medical device, electronics, and consumer products industries.

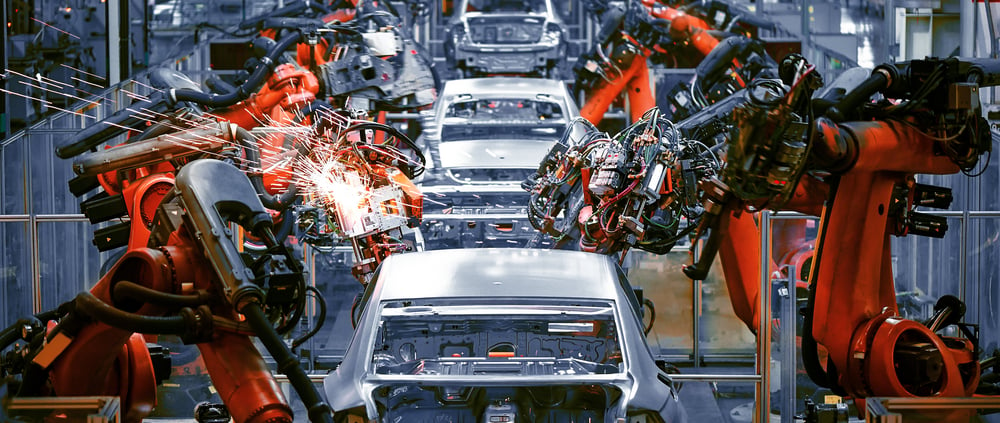

1. Automotive Industry Manufacturing in Mexico

Mexico’s automotive manufacturing industry has a lengthy history and an established presence in virtually every corner of the country. Today, Mexico is the 4th largest exporter of auto parts in the world, and the first in automotive industry exports to the United States.

- Where to find industrial clusters in the country: Automotive clusters can be found in Coahuila, San Luis Potosí, Baja California, Nuevo León, Jalisco, Sonora, and Guanajuato. There’s a particular emphasis in Hermosillo, Sonora, and Saltillo, Coahuila, also known as the Detroit of Mexico.

- Largest automotive manufacturing companies: Ten automotive OEMs have established a presence in Mexico: BMW, Chrysler, Ford, GM, Honda, Kia, Mazda, Nissan, Toyota, and Volkswagen. These companies alone have 20 plants within Mexico and across the country.

- Trends to watch: Automotive manufacturing in Mexico is helping pave the way for progress on key industry trends. Mexico’s factories have geared up to support the shift to electric vehicles.

2. Aerospace Manufacturing Industry in Mexico

Aerospace manufacturing in Mexico accounts for almost half of the country’s foreign direct investment, and it continues to grow. In 2021, Mexico’s aerospace industry was valued at $6.22 billion and was projected to register a CAGR of more than 18% through 2027. The country exports products ranging from engine parts to fuselages, landing gear, and avionics, among many other components needed across the world.

- Where to find industrial clusters in the country: Mexican states known for aerospace manufacturing include Queretaro, Sonora, Chihuahua, Nuevo Leon, and Baja California.

- Largest aerospace manufacturing companies: Mexico is home to around 300 aerospace manufacturing companies, including OEMs, Tier 1, 2, and 3 suppliers across the country. The hub in Queretaro alone is home to Bombardier, GE IQ, Safran, Airbus, Delta, Eurocopter, Aernnova, Meggitt, ITR, Cormer, Regent, and Liberty Spring.

- Trends to watch: Nearly 79% of manufacturing firms operating in Mexico produce aerospace components, but some of these manufacturers may be looking in a new direction. The Mexican Federation of the Aerospace Industry (FEMIA) has proposed the local aerospace industry explore opportunities to support the global space industry.

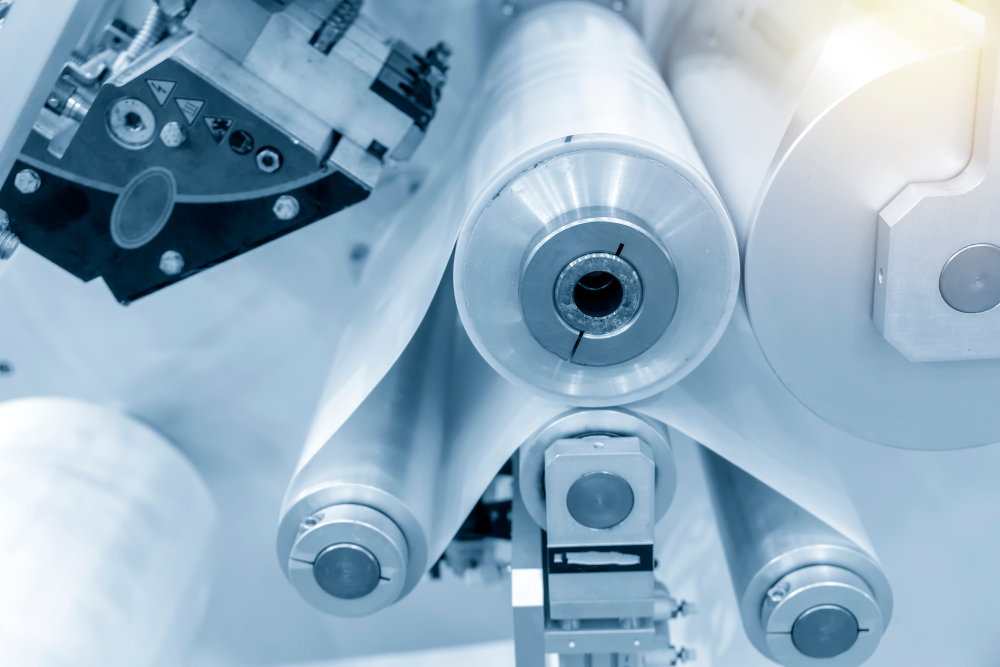

3. Medical Device Manufacturing in Mexico

In 2019, Mexico was one of the largest exporters of medical devices, equipment, and components across the world, exporting $11.7 billion worth of goods. Forecasts predict Mexico’s medical device market will see CAGR increase 8.4% by 2025, making it one of Mexico's biggest industries.

Delicate medical devices often need to be manufactured by hand and require various stages of construction with delicate materials. This multi-part assembly process requires highly skilled labor abilities, which are commonly found in Mexico’s workforce.

- Where to find industrial clusters in the country: Baja California has the largest cluster, with 67 medical device companies in the state. However, medical device manufacturing also has a significant presence in Chihuahua, Sonora, Coahuila, Jalisco, Nuevo León, and Tamaulipas.

- Largest medical device manufacturing companies: Mexico’s medical device industry manufactures many products from almost 650 companies that export about $8 billion USD. Medical device manufacturers in Mexico include GE, Medtronic, Siemens, Cardinal Healthcare, Tyco, Becton Dickinson, 3M, Stryker Incorporated, Kimberly Clark, Boston Scientific, and Johnson & Johnson, among others.

- Trends to watch: Amendments made in 2021 to Mexico’s health supplies regulations are expected to make it easier than ever for international medical device manufacturers to enter the local market. These changes are expected to simplify administrative processes and reduce regulatory burdens for medical device manufacturers..

4. Electronics Manufacturing in Mexico

.jpg?width=1000&name=shutterstock_1393815866%20(1).jpg)

Electronics manufacturing in Mexico is seeing particularly explosive growth, as it supports not only tremendous demand for consumer electronics but also the cutting-edge components used by trucks and automobiles, airplanes, appliances, medical devices, computers, and other manufacturing operations that feature electronic components.

- Where to find industrial clusters in the country: Mexico's electronics manufacturing maintains different specialties in two parts of the country. The western part of Mexico specializes in manufacturing aerospace, hi-tech, IT, and electronic sub-assembly parts in the states of Baja California, Sonora, Chihuahua, Jalisco, and Aguascalientes. Eastern Mexico specializes in manufacturing parts for computers, home appliances, and consumer goods in Coahuila, Mexico City, Nuevo León, Querétaro, and Tamaulipas. EMS manufacturers specializing in automotive and telecommunications components can be found in both regions.

- Largest electronics manufacturing companies: Guadalajara has earned the nickname of Mexico’s Silicon Valley, as it has become a hub for software and EMS manufacturing operations. Twelve OEMS and more than 380 specialized suppliers export about $150 billion annually from here. Some of the companies in Guadalajara include Plexus, IMI, IKOR, Flex Ltd., V-TEK, InterLatin, Sanmina, QSS, JABIL, Molex, OMP Mechtron, and Talos.

- Trends to watch: Even during global shutdowns in 2020, Mexico’s consumer electronics market saw record sales volumes—and sales have only increased since there. It’s become one of the country’s fastest-growing manufacturing segments.

5. Appliance Manufacturing in Mexico

As the 5th largest exporter of appliances in the world, household manufacturing has a strong foothold in Mexico. Many companies in the appliance sector gravitate towards other industry clusters, most notably electronics, to pull from a similar workforce knowledge and supplier network.

- Where to find industrial clusters in the country: Forty-one percent of all appliances manufactured in Mexico begin in Nuevo Leon. Saltillo, Queretaro, Guanajuato, San Luis Potosi and Tamaulipas are other hotspots for appliance manufacturing in Mexico.

- Largest appliance manufacturing companies: Sony, Whirlpool, GE, Zuo, Amana, Danby, Ethan Allen, EMZ, SIEMENS, and Diehl Controls are some of the main household manufacturing companies in Mexico.

- Trends to watch: Appliances have gotten smarter, and these new capabilities are driving consumer demand. Many of the major brands made in Mexico are part of the smart device revolution. Forecasts suggest the smart home appliance market alone will have a CAGR of 48% from 2021 through 2026.

6. Textile Manufacturing in Mexico

.jpg?width=1000&name=shutterstock_1634572060%20(1).jpg)

Textile manufacturing has been a core part of Mexico’s industry since the country’s first textile factory opened in Puebla in 1830. Today, Mexico sees annual textile exports of USD $7 billion each year, making the textile and apparel industry one of Mexico’s strongest manufacturing sectors.

- Where to find industrial clusters: INEGI reports that 63% of Mexico’s textile industry is concentrated in the central and northeastern parts of the country. Puebla remains a hub today, but so too are Mexico City, and the states of Mexico, Hidalgo, Tlaxcala, Jalisco, Queretaro, Coahuila, Sonora, Guanajuato, Nuevo Leon, and San Luis Potosi.

- Largest textile manufacturing companies: Apparel manufacturers like Delta Apparel, Grupo Denim, and Levi Strauss & Co. and countless others have a strong presence in Mexico. However, there are also a number of companies involved in more technical textiles, such as airbag provider UTT and specialty fabric providers Carolina Performance and Toray Industries.

- Trends to watch: Demand for technical textiles, industrial fabrics, and specialty apparel is increasing. However, Mexico’s fashion sector is also driving innovation to help it compete. For example, Yucatán recently became home to Mexico’s first design, innovation and prototyping lab for the fashion industry, created through an investment from the state government. Overall, experts predict the textile manufacturing market in Mexico will grow by USD 3.98 billion from 2021 through 2026, with a CAGR of 4.13%.

What are the industrial parts of Mexico?

Mexico has several robust manufacturing hubs. These economic centers for Mexico manufacturing companies include Monterrey, CDMX, Guadalajara, Queretaro, and Guanajuato. Each of these locations offers low labor costs, skilled workers, and accessible trade, making them ideal for Mexican companies.

What is the growing industry in Mexico?

While there are several thriving sectors in Mexico, the electronic components manufacturing industry continues to grow at an exponential rate and is the fastest growing industry in the country. The audio and video equipment industry follows close behind in its annual growth rate.

Leveraging Shelter Services for Successful Expansion into Mexico's Manufacturing Industries

If you are a manufacturing company operating within any of these burgeoning industries and considering expansion into Mexico, partnering with a shelter provider like Tetakawi can be a strategic move.

As these Mexico industries continue to thrive, the opportunities for expansion and growth are significant. However, navigating a new business environment, especially in a foreign country, can be complex and challenging, presenting various burdens and risks. These can range from understanding and complying with local and national regulations, both environmental and otherwise, to managing logistics, securing suitable facilities, and accessing skilled labor.

Tetakawi, with its deep expertise in Mexican manufacturing operations, can help your company leverage the advantages of manufacturing in Mexico while mitigating the risks. By providing essential services such as regulatory compliance, HR and recruitment, import/export support, and more, Tetakawi allows you to focus on your core competencies and business objectives.

To learn more about manufacturing in Mexico, including modes of entry, popular locations, and manufacturing costs, contact Tetakawi or watch the webinar below.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.