Electronics manufacturing skills are in high demand, as electronics are now integral to more complex devices than ever before. Beyond consumer electronics, industries such as automotive, aerospace, medical device manufacturing, telecommunications, and industrial machinery rely on printed circuit board manufacturing and wiring harness assembly, among others. However, according to IPC, a global trade association for professionals in the electronics industry, electronics manufacturers worldwide find it difficult to recruit and upskill enough workers to meet growing product demand.

Many of these manufacturers are finding solutions in Mexico, where the electronics manufacturing sector is strong and has ample room for growth.

Challenges U.S. Electronics Manufacturers Are Facing

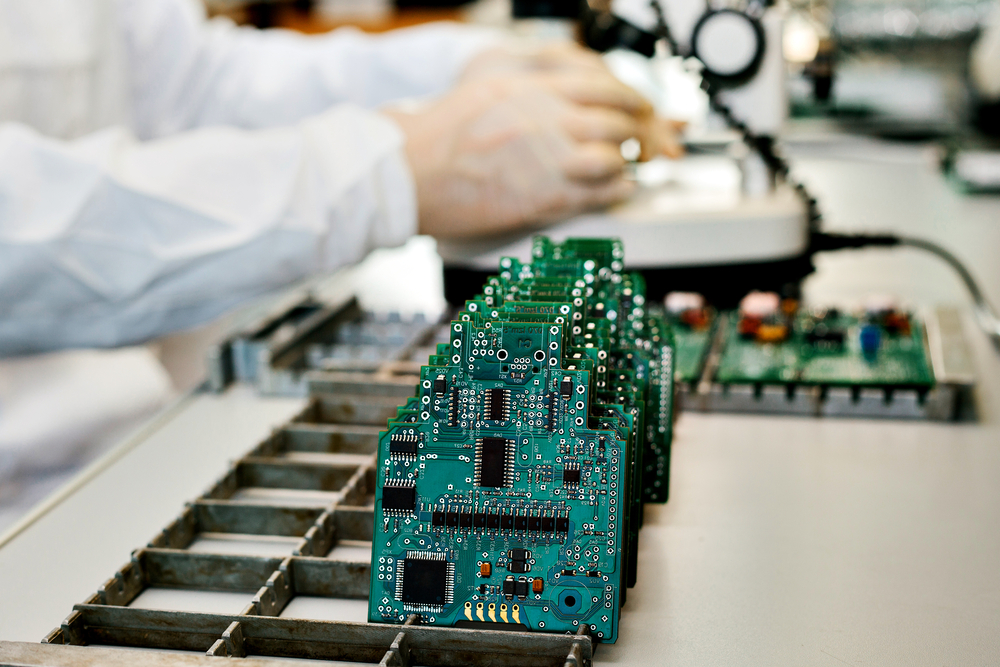

In its "Building Electronics Better" white paper, IPC explains that electronics manufacturers often rely on an influx of typically unskilled machinery operators. Key roles such as PCB, wire harness, and assembly operators require basic manufacturing skills, including taking measurements, reading assembly instructions, and interpreting tolerances.

Because these basic skill sets are also needed by manufacturers in other sectors, it can be challenging to find workers already equipped with these abilities. Moreover, few electronics manufacturers in the U.S. have established talent pipelines that prepare K-12 students with manufacturing skills or build awareness about job opportunities.

Advanced Technical Skills Needed

In addition to basic skills, electronics manufacturers need a pipeline of manufacturing and production technicians capable of programming, operating, and maintaining the automated systems found in modern factories. Equally important, companies require production and manufacturing engineers, quality engineers, and PCB designers with industry-specific training.

For years, the U.S. has struggled to develop the necessary talent pipeline to serve the manufacturing industry, especially as older workers retire. The Manufacturing Institute (MI) and Deloitte predict that this lack of a pipeline will result in 2.1 million unfilled jobs by 2030. The MI attributes this to younger workers' lack of interest in the industry, partly due to misconceptions about manufacturing careers.

Mexico's Competitive Advantage

However, this lack of interest is not universal. In Mexico, manufacturing jobs provide competitive wages and stability. Mexico's workforce benefits from generations of manufacturing experience and access to educational and training institutions dedicated to manufacturing success. As a result, many electronics manufacturers are finding solutions in Mexico, where the electronics manufacturing sector is robust and has ample room for growth.

Mexico’s Electronics Manufacturing Industry

One reason for the lack of a robust U.S. electronics manufacturing talent pipeline is the longstanding outsourcing of this service to China. Today, as manufacturers aim to shorten lead times and reduce risk by moving production closer to the United States, Mexico has emerged as a frontrunner.

Northwest Engineering Solutions, which provides product design services for the defense and aerospace industries, highlights the profound advantages of shifting electronics manufacturing from China to Mexico. This shift allows for closer collaboration between electronics engineers and manufacturing partners. The proximity between Mexico and the United States facilitates easy visits to manufacturing sites, enabling engineers to observe production processes firsthand and collaborate closely with manufacturing teams.

According to Northwest, this proximity enhances communication, speeds up problem-solving, and increases the likelihood of innovation.

Many companies have successfully manufactured electronics in Mexico for decades. Investors in Mexico’s electronics manufacturing sector include well-known companies such as Dell, LG, Sony, Toshiba, Samsung, RCA, Phillips, Panasonic, Siemens, and Vizio, among others. Mexico ranks as the 8th largest producer of electronics worldwide. However, as DigiTimes Asia reports, “Mexico's electronics industry is experiencing a remarkable surge, transforming the nation into a powerhouse for semiconductors, AI applications, and beyond.”

DigiTimes points to significant commitments from chipmaker Micron and electronics manufacturer Foxconn to invest in factories in Mexico as indicators of “a significant shift in the global electronics landscape.” Other signs of this growing shift include the U.S.-Mexico semiconductor production partnership, which has been made possible in large part by Mexico’s talented electronics manufacturing workforce.

Mexico’s Electronics Manufacturing Workforce

Mexico graduates an average of 130,000 engineers and technicians each year, exceeding the number of engineers matriculating in the U.S. per capita. These specialists come from more than 25 higher education institutions across Mexico, including Tecnologico de Monterrey near Saltillo, Universidad Autónoma de Sinaloa near Mazatlán, and Universidad de Sonora in Hermosillo.

Another significant benefit of Mexico's workforce is the median age, which is relatively young. This young workforce is not only skilled but also shows a strong willingness and desire to work in the manufacturing industry—a stark contrast to the U.S., where there is often less interest in manufacturing careers among younger workers.

Additionally, there are numerous manufacturing education programs across Mexico that allow employees to gain hands-on experience while pursuing technical training. Some of these programs operate like internships, allowing students to gain real-world experience within Mexico’s maquiladoras. Many are developed by CONALEP (the National College of Professional Technical Education), which partners with campuses across the country to provide training for technical professionals who may or may not be looking to pursue a four-year degree. CONALEP has helped manufacturers create a talent pipeline prepared with essential manufacturing skills.

Perhaps more importantly, electronics companies considering expansion into Mexico can benefit from the shelter program. The shelter program is typically the quickest, most cost-effective, and risk-averse way for a company to expand into Mexico. It allows companies to operate in Mexico without establishing a legal presence and handling administrative and regulatory compliance while the companies focus on manufacturing. Through its shelter program, Tetakawi has helped successful electronics manufacturing companies like TE Connectivity, St. Clair Technologies, CBC, Huber & Suhner, Unlimited Services, Infinite Electronics, and many others successfully launch, operate, and thrive in Mexico.

FAQ: How Do I Set Up an Electronics Manufacturing Facility in Mexico?

A: Setting up an electronics manufacturing facility in Mexico involves several key steps:

-

Define Your Objectives: Identify your manufacturing needs, target markets, and production goals.

-

Evaluate Locations: Research and visit potential locations to assess their suitability based on infrastructure, labor availability, and logistics.

-

Understand Legal and Regulatory Requirements: Familiarize yourself with Mexico's legal and regulatory environment, including labor laws, environmental regulations, and tax implications.

-

Consider Mode of Entry: Determine the best way to enter the Mexican market. Common modes of entry include:

- Shelter Program: Allows companies to operate in Mexico without establishing a legal presence, handling administrative and regulatory compliance.

- Contract Manufacturing: Partner with existing manufacturers in Mexico.

- Joint Ventures: Form a partnership with a local company.

- Wholly-Owned Subsidiary: Establish a fully owned company in Mexico.

-

Secure Industrial Real Estate: Find a suitable industrial space that meets your production needs and has the necessary facilities for training and operations. A shelter service provider can help facilitate this process.

-

Recruit and Train Workforce: Leverage local educational institutions and training programs to recruit skilled labor. A shelter service provider can help facilitate this process.

-

Set Up Operations: Install equipment, establish production lines, and ensure all operational processes are in place. Shelter providers can facilitate this setup.

-

Ongoing Management and Optimization: Continuously manage and optimize your operations, ensuring compliance with local regulations and adapting to market demands. Shelter providers can offer ongoing support to facilitate this.

For a more detailed guide, you can read our comprehensive article on Building a Business Case for Manufacturing in Mexico.

Conclusion

Setting up an electronics manufacturing facility in Mexico is a strategic move that offers numerous benefits, from access to a skilled and young workforce to proximity to the U.S. market. With comprehensive support through a shelter program, manufacturers can quickly and cost-effectively establish and grow their operations in Mexico. Services include recruitment, onboarding, HR management, and access to state-of-the-art training facilities, ensuring your workforce is prepared to excel.

As IPC points out, the electronics manufacturing market is expected to grow from approximately $534 billion in 2023 to $856 billion by 2030. There has never been a better time to expand your operations into Mexico. By leveraging expertise and resources, you can navigate the complexities of the Mexican market and achieve operational success.

Ready to take the next step? Contact Tetakawi today to start building your talented workforce and thriving in the vibrant Mexican manufacturing landscape.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

Table of Contents:

- Challenges U.S. Electronics Manufacturers Are Facing

- Advanced Technical Skills Needed

- Mexico's Competitive Advantage

- Mexico’s electronics manufacturing industry

- Mexico’s Electronics Manufacturing Workforce

- FAQ: How Do I Set Up an Electronics Manufacturing Facility in Mexico?

- Conclusion