Supplier Network, Federal Support Attracts Car Manufacturers to Mexico

The Mexican automotive manufacturing industry has grown to become the country's largest manufacturing sector, employing more than one million people. Virtually all of the major car manufacturers have a factory in Mexico today.

This presence has made Mexico the seventh-largest manufacturer of passenger and cargo vehicles globally, the fifth-largest producer of auto parts worldwide, and the leading exporter of tractor trucks worldwide. The vast majority of this vehicle production–90%–is ultimately exported, with 76% going to the United States.

Mexico's evolution into a prominent manufacturing hub is driven by its robust automotive industry, strategic trade agreements, and competitive operational costs. As a manufacturing hub, Mexico attracts numerous global car manufacturers, leveraging its skilled workforce and well-established supply chains to produce high-quality vehicles efficiently.

The country's strategic location, coupled with extensive free trade agreements, makes it an ideal base for automotive companies aiming to export vehicles worldwide. The continuous federal support and investment in manufacturing infrastructure further solidify Mexico's position as a leading manufacturing hub in the global automotive market.

1900s-1960s: The start of the Mexico automotive industry

Automobiles first arrived in Mexico City in 1902. From 136 cars in 1902, automobile traffic increased to 800 vehicles on the road by 1906. This growth led President Porfirio Díaz to form the first Mexican Highway Code. Shortly after the Mexican Revolution ended in 1920, the automotive industry in Mexico began to flourish. In 1921, Buick became the nation's first trademark to be legitimately established in Mexico.

However, it was in 1925, when Ford Motor Co. established its plant in Mexico, that the country's automotive roots truly took hold. Ford's presence as the longest-operating automotive industry manufacturer in Mexico has played a significant role in shaping the industry's growth and success.

In the mid-1930s, General Motors made its grand entrance into Mexico, solidifying the country's position as a favorable choice for low-cost production among U.S.-based automotive manufacturers. This move was followed by Chrysler's operations in 1937, further establishing Mexico's appeal. While the Detroit Big Three took the lead in expanding into Mexico, it wasn't until the 1950s and 1960s that carmakers from around the world began to follow suit.

As the 1960s dawned, Toyota Motor forged a partnership with a local company to commence the production of their renowned Land Cruiser and other vehicles. Similarly, Nissan set up its first manufacturing center outside of Japan in Mexico in 1961, where it started producing Datsun models. Volkswagen also entered the scene by establishing its Mexico headquarters in Puebla in 1964, with the iconic Beetle proudly rolling off the production line in 1967. The manufacturing sector in Mexico experienced remarkable growth during this decade, expanding by 7% annually.

1960s-1970s: New regulations and economic uncertainty

During the 1960s, Mexico implemented an automotive decree in 1962 with the objective of developing a domestic car manufacturing sector that would stimulate job creation and technological advancement. This decree included a ban on the import of vehicles, engines, and major automotive parts, set requirements for local value-added materials, and limits on foreign ownership of auto parts plants. As a result, some foreign car manufacturers, including Mercedes Benz, FIAT, Citroën, Peugeot, and Volvo, chose to leave the country. However, the American Big Three, along with American Motors, Renault, Volkswagen, and Borgward, remained.

In addition to the automotive decree, the 1960s also saw the introduction of Mexico's maquiladora program. Initially aimed at encouraging foreign investment and boosting domestic employment rates, the program took several decades to reach its full potential.

In 1972, the Mexican government implemented new regulations to enhance trade performance in the automotive industry. These changes allowed for lower domestic content in exported vehicles and required auto companies to export a minimum of 30% of their imports. By 1975, auto industry exports accounted for less than 16% of the industry's import bill. Consequently, Mexico took significant steps to become internationally competitive, leading many automotive companies to modernize their plants to meet the new parts requirements.

1980s-1990s: Growth of Mexico's economy

Despite facing an economic slump in the 1980s, policies set in place began to encourage additional foreign investment in the automotive sector. Among the most notable investments was the launch of a joint Ford and Mazda plant in 1986 in Hermosillo, Sonora. Although parts were originally shipped from Japan, the emergence of local suppliers drove a steady increase in local content. To allow for rapid production shifts between different models of sedans, Ford invested more than a billion dollars in a nearby supplier park, which significantly increased the plant's productivity to a capacity of 300,000 units a year.

This strengthening supplier network wasn't the only incentive spurring dramatic growth. Between 1989 and 1993, Mexico began to pursue new policies to deregulate the automotive industry in Mexico and make it more attractive for foreign investment. Among these reforms were changes to the maquiladora program that allowed maquiladoras to sell up to 50% of their products to domestic markets in Mexico.

With the passing of the North American Free Trade Agreement (NAFTA) in 1994, the Mexican automotive industry gained greater traction. Under NAFTA, maquiladoras benefited from waived Mexican import duties and preferential rates on duties for specific products. These benefits made it much easier for the manufacturing industry in Mexico to grow as a manufacturing partner for companies in the U.S. and around the globe. Two-way trade with the U.S. under NAFTA was a catalyst for major economic growth.

During the late 1990s, the growth of Mexico's economy spurred increased car sales in Mexico. Eventually, most of the carmakers that had left the country in the 1960s reestablished themselves in the country.

2000s-2010s: The automotive industry evolves under IMMEX

Annual passenger vehicle sales in Mexico reached one million in 2005. This growth came in part from the continuing strengthening of the local supplier change, as well as the establishment of additional incentives for foreign investment.

In 2006, the IMMEX Program (which stands for the Maquiladora, Manufacturing and Export Services Industry) established additional benefits to the existing maquiladora program. It reduced costs and the burdens of moving into Mexico. The program offers the option of one of five IMMEX registrations, which are based on the type of product or service exported: Holding Company, Industrial, Services, Shelter, and Outsourcing.

By incentivizing manufacturers to export goods, the IMMEX program led to a 99% increase in overall export trade in just over a decade. In 2019, that amounted to $52.4 billion in vehicle exports, making cars Mexico’s largest export. Those vehicles were overwhelmingly (73%) being shipped to the United States.

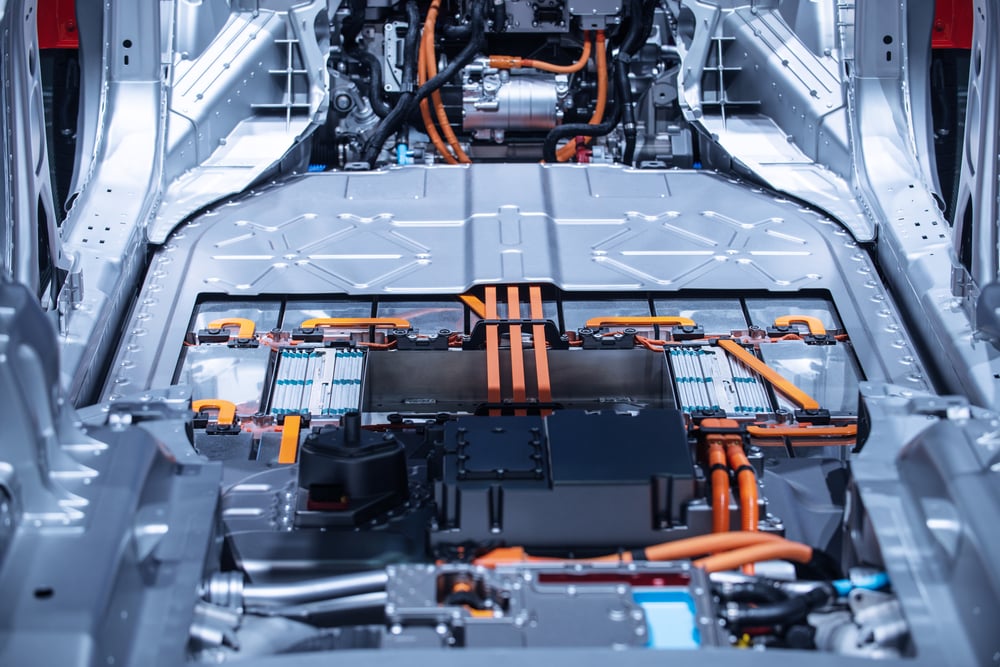

While the Mexico automotive industry saw tremendous growth at this time, the last few years of the 2010s were also marked by industry shakeups and global uncertainty. In 2005, with the Ford Fusion sedan and Lincoln MKZ premium car, Ford became the first company to manufacture hybrid cars in Mexico. By the late 2010s, it was becoming evident that electric vehicles (EVs) would be the manufacturing standard of the future, and companies began to restructure their supply chains and update factories to keep up. At this same time, plans began for a replacement for NAFTA, leaving many companies questioning their future in Mexico.

2020s: What's in store for the future

In 2020, NAFTA was replaced with the passage of the U.S.-Mexico-Canada Agreement. Most notably, USMCA updated the rule of origin requirements, mandating that automakers use 75% North American content, compared to 62.5% under NAFTA. This shift offered an additional incentive for automakers to increase their presence in Mexico.

This incentive was only strengthened when, in 2020, a global pandemic shut down factories and shook supply chains around the world. Manufacturing organizations everywhere felt the shock, and many came out of the pandemic determined to create a more resilient regional manufacturing footprint. Mexico became a nearshoring destination for automakers and suppliers due to its proximity to the U.S. market. In a short time, Mexico’s automotive industry had rebounded and grown its network.

Mexico's strong network of free trade agreements (FTAs) only add to its appeal as a global export base. According to calculations from the Center for Automotive Research, Mexico's FTAs lead to tariff savings of more than $4,000 per vehicle in exporting a $25,000 vehicle to the European Union. The tariff advantage grows proportionally with vehicle value.

Among the companies moving to Mexico is Tesla, which announced in 2023 its plans to build a gigafactory near Monterrey. The EV leader determined that low shipping and production costs made Mexico the most feasible choice for a location able to produce an affordable $25,000 EV.

As leaders in the Mexico automotive industry make the switch to all-electric vehicles, excitement has mounted over the 2019 discovery of lithium deposits in Hermosillo, Sonora. Lithium is a key component used in the production of EV batteries. With the federal government’s decision in 2022 to nationalize any future lithium mining, experts predict that the next decade may

Cement your place in Mexico’s automotive industry

Today, Mexico is home to established automakers, including Audi, Baic Group, BMW, FCA Group, Ford, GM, Honda, Kia, Mazda, Mitsubishi, Nissan, Toyota, and Volkswagen. A strong network of automotive clusters supports these OEMs.

Mexico's long history in automotive manufacturing has pushed the domestic supply chain to strengthen while incentivizing foreign investment. It's become a powerful recipe for high-quality, low-cost vehicle production. Now, with more than 3 million cars built in Mexico each year, most of them exported for sale around the world, Mexico's reputation as an automobile-building dynamo has been proven.

Becoming a manufacturing powerhouse doesn't happen all at once—and it doesn't happen without the right support. If you're ready to join Mexico's automotive manufacturing industry, contact Tetakawi to learn about the quickest, most cost-effective, and risk-averse way to establish a maquiladora.

Subscribe

Sign up and stay informed with tips, updates, and best practices for manufacturing in Mexico.

Table of Contents:

- Supplier Network, Federal Support Attracts Car Manufacturers to Mexico

- 1900s-1960s: The start of the Mexico automotive industry

- 1960s-1970s: New regulations and economic uncertainty

- 1980s-1990s: Growth of Mexico's economy

- 2000s-2010s: The automotive industry evolves under IMMEX

- 2020s: What's in store for the future

- Cement your place in Mexico’s automotive industry